Joust partners with Lendela to expand financial empowerment

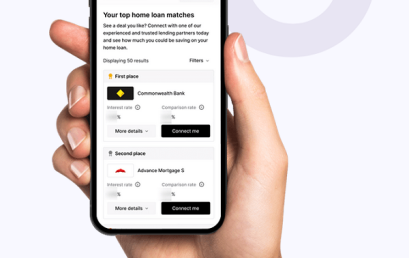

Home loan marketplace Joust have announced its partnership with Lendela, a prominent player in the personal loan industry.

IDVerse partners with online digital lending platform Nimo to fast-track home loans

IDVerse partners with Nimo, an award-winning online lending platform that delivers same-day, digitised lending from enquiry to settlement.

Introducing Australian FinTech’s newest Member – CFI Finance

As an independent finance company CFI Finance have the flexibility to learn more about their customers and to say yes more often.

Ethical-lending fintech Beforepay recognised in Wealth & Finance International FinTech Awards

ASX-listed Beforepay has been named Ethical Lender of the Year 2023 – Australia in the FinTech Awards hosted by Wealth & Finance International

Funding.com.au signs with Finsure

Funding.com.au and Finsure have partnered to make Funding’s bridging, business and building loan products available to Finsure’s brokers.

MONEYME becomes 3rd ASX-listed financial institution with B Corporation certification

Digital lender and non-bank challenger MONEYME has become the third ASX-listed finance provider in Australia to become a Certified B Corporation.

Bridging loan specialist Bridgit sees market changes and adapts product structure to meet new demand

Bridgit has been closely monitoring the needs of Australian homeowners alongside the recent market fluctuations.

Non-bank lender Firstmac prices $1.2 billion Residential Mortgage-Backed Securities issue

Firstmac has dispelled fears about weakness in the Residential Mortgage-Backed Securities (RMBS) market by successfully pricing a $1.2 billion issue at a tight yield.