Resimac acquires stake in fintech finance company

Resimac has purchased a 15% stake in Australian fintech company Positive Group, a pool of finance companies dealing with asset finance, mortgages and advice

Crowdfunding as a game changer for SMEs

Crowdfunding and the new equity rules have the potential to be a game changer for Australian proprietary companies.

The changing face of financial advice

Open banking platform Basiq and CRM software provider AdviserLogic have partnered to solve this issue and improve the way financial advice is given.

GBST opts to go with SS&C

Financial services technology provider GBST looks set to go with a takeover bid by Nasdaq-listed SS&C after being the subject of offers from Bravura and FNZ

Don’t forget, the ATO wants to tax your Crypto

The Australian Tax Office recently declared its intention to target crypto traders who are avoiding paying the proper amount of tax.

Two new fintech players in lending and deposits

RBA data shows that approved deposit taking institutions (ADIs, mainly the banks) held $624 billion of deposits in term accounts as of April 2019

The spectre of cryptocurrency is spurring banks into action

Goldman Sachs is weighing the idea of launching a cryptocurrency of its own, CEO David Solomon said late last week.

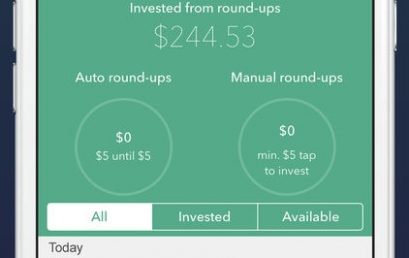

Spare change investor start-up expands into Thailand and Vietnam

Raiz allows users to round-up everyday purchases and pool their spare change to invest in equities, bonds and other securities.