ASIC updates information for businesses on ICOs and crypto-assets

ASIC has released new information to help businesses involved with initial coin offerings (ICOs) and crypto-assets to consider their legal obligations and satisfy themselves they are operating lawfully.

NAB, Bank Leumi & CIBC launch Global Alliance Fintech Link

Bank Leumi of Israel, CIBC and National Australia Bank today introduced the Global Alliance Fintech Link.

Austrade deepens Southeast Asia-Australia startup collaboration

The Australian Trade and Investment Commission (Austrade) Landing Pad in Singapore has officially unveiled its latest cohort of promising startups.

Australian FinTech company profile #19 – Fabric

Fabric is a developer-friendly Open Banking service layer where users are able to securely authenticate their banking credentials

$22b of bank revenue at risk from smartphone wallets: Morgan Stanley

Smartphone digital wallets offered by Google, Apple and other technology giants will put $22 billion of revenue across the major Australian banks at risk, according to Morgan Stanley

What the future of Fintech looks like

What’s next for the future of fintech. Fintech has been a “hot” sector for quite some time now. Last year the global funding in the sector rose to US$111.8B

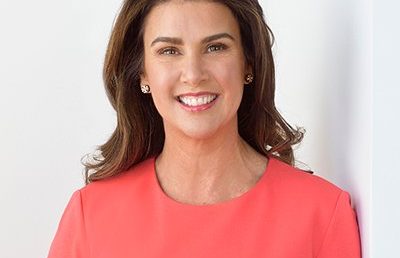

Meet Australia’s FinTech minister

Senator Jane Hume has become sworn in as Australia’s first assistant minister for financial technology in Prime Minister Scott Morrison’s second ministry.

Bills can now be paid with cryptocurrency even if biller doesn’t accept it

Thanks to Gobbill and Cointree, Australians who own cryptocurrency can use it to pay household bills even if the biller doesn’t accept digital money.