Trend Micro introduces Australian-first automated Open Banking solution for secure data sharing, built on AWS

Trend Micro announce the availability of Australia’s first Consumer Data Right (CDR) Open Banking automated compliance check.

Frollo leads Australia into new era of the Consumer Data Right with first access to Open Banking data on launch day

With Open Banking data, Frollo can help consumers identify when they are missing out, paying too much or should switch to a better deal with their bank.

10 questions from Frollo’s webinar: Comply and Compete with Open Banking data

Here is an update and 10 questions from Frollo’s recent webinar: Comply and Compete with Open Banking data.

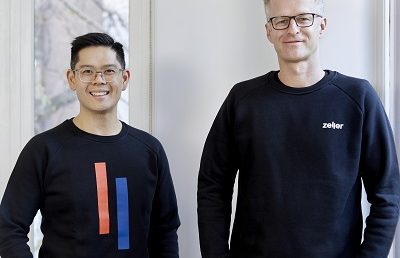

Australian fintech Zeller raises $6.3m to reimagine business banking

Former Square executives, Ben Pfisterer and Dominic Yap have unveiled Zeller, a new company focused on offering a true alternative to business banking.

Open Banking tipped to shape investment

While public discussions around the Consumer Data Right have focused on the retail banking sector, there are clear ramifications for trading and investment.

Cash warns banks to reduce ‘tap and go’ fees

Senator Cash stated that many retailers had raised concerns that banks are not offering to send ‘tap and go’ payments down the cheapest payment network.

Promising fintech Wych selected as test partner for Australian ACCC CDS/CDR standards

Wych, the NZ AI-powered financial personal assistant, announce their selection as a test partner for the forthcoming Australian ACCC.

Mambu announces global partnership with Google Cloud to accelerate customers’ move to cloud

Leading cloud banking platform Mambu announce partnership with Google Cloud to continue to grow its reach and seamlessly deliver service around the world.