NAB takes the fight to Afterpay with no interest credit card

National Australia Bank is hoping to reel in younger customers with its new no interest credit card, called the ‘StraightUp’ card.

Consumer Data Right legislation should make it easier to compare Fintech products, according to Australian government official

The Consumer Data Right legislation in Australia has been introduced to enhance the nation’s modern banking sector.

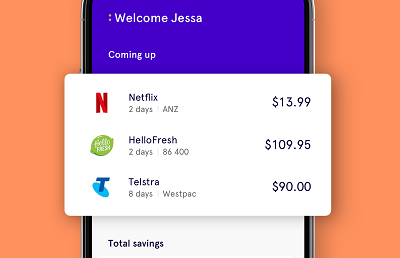

One year on: meet the 86 400 customers banking smarter and saving big

From Mackay to Melbourne, and Brisbane to Broome, 86 400 customers young and old are taking advantage of the bank’s smart products and are banking smarter.

86 400 welcomed onto another aggregator’s panel

Neobank 86 400 has been welcomed onto the lender panel of Australia’s first broker-owned aggregator, Purple Circle Financial Services.

Ignition Advice and Avaloq announce global partnership

Ignition Advice continues its strong growth strategy, announcing a global partnership with one of the world’s leading financial services, Avaloq.

Up’s next gen banking

Within a day of UP’s API launch, their next gen banking customers were trialling “crazy” ideas but importantly, it helped boost financial engagement.

The Frollo ADR checklist

Frollo have published their ADR checklist: an easy overview of the steps to take and the things to think about when applying to become an ADR.

Making finances simple with the Envestnet Yodlee financial data platform

86 400 needed seamless access to customers’ financial data along with APRA approval and found Envestnet Yodlee to be an obvious candidate.