P&N Group partners with Frollo to re-imagine the future of banking

Customer-owned P&N Group has announced a new partnership with Frollo, that will see the future of banking re-imagined for its customers.

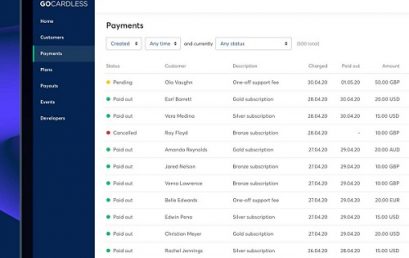

GoCardless: tapping the fintech opportunity in Australia with bank-to-bank payments

GoCardless is on a mission to help businesses with recurring revenue manage their receivables by enabling bank-to-bank debit.

Banks must come to the table to financially empower Australians

Nimble CFO Grant Mackenzie stresses that Australian banks must come to the table to financially empower Australians.

New digital bank Alex secures banking licence

Australia’s newest digital bank, Alex, has been granted a restricted banking licence from the Australian Prudential Regulation Authority (APRA).

TrueLayer releases report on new CDR rules

The big question TrueLayer is now being asked is: which access model works best for my business to leverage the benefits of open banking data?

Australian Treasury proposes to lower barriers to CDR participation

Rule amendments include changes to reduce barriers to participate in open banking and increase participation in the CDR by data recipients and consumers.

SISS facilitates open banking innovation with free sandbox

SISS Data Services has today made available the ACSISS sandbox environment for fintechs wishing to join the open banking environment.

86 400 accelerates broker network with new PLAN Australia partnership

Australia’s first smartbank, 86 400, is today announcing its partnership with one of Australia’s largest mortgage aggregators, PLAN Australia.