Understanding the SME mindset

In 2017, the number of business owners turning to their primary bank for a loan declined 14%. Scottish Pacific CEO, Peter Langham, explains why brokers are uniquely positioned to capitalise The latest SM Growth Index by Scottish Pacific paints a clear picture of SME owners, their pain points, and their funding needs and intentions. For brokers, these results can help them understand the SME mindset and why it is important to offer a range of suitable funding options, which allow both clients and their brokers to grow. Just over half the businesses polled expect revenue to grow in 2018, and two thirds reported improved cash flow for 2017. Those that are […]

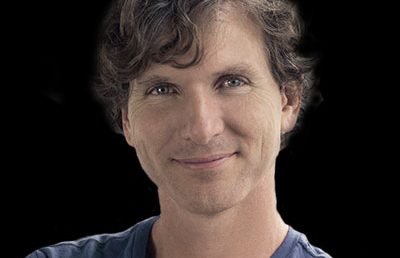

Square’s Jack Dorsey muscles in where banks have failed to serve

Billionaire Square co-founder Jack Dorsey says big banks have allowed his payments disrupter to muscle in on their territory by breaking the trust of customers and serving small business borrowers poorly, or not at all. Mr Dorsey, who also co-founded social media platform Twitter, said a long history of corruption had tarnished the reputation of the financial services sector, but with Square he hoped to restore trust in the industry. “The banking industry was invented in the 1600s in Florence and there has been corruption ever since,” Mr Dorsey said while in Melbourne for the second anniversary of Square’s local launch. “It’s not something that’s new to a particular country, […]

Think you’ve innovated? Enter the finder Awards 2018 to show ‘em what you’ve got

We’ve seen our fair share of fintech innovations over the past few years. From robo-advice to peer-to-peer (P2P) lending to Blockchain, innovation has been offered in spades within the Australian marketplace. The finder Awards 2018 celebrates excellence in local business innovation by recognising creativity and impact across key industries including banking, property, retail, travel and of course, fintech. Comparison site, finder.com.au, invites the nation’s most forward-thinking businesses, both big and small, to step forward and showcase their best innovation. From Best Tech Innovation to Best Personal Finance App, there are seven innovation categories now open for submission. These include; Best Tech Innovation Best Online Shopping Innovation Most Innovative Team/Person Best […]

Bank limitations create opportunities for non-bank lenders

Winners and losers from new bank regulations Small and medium sized enterprises (SMEs) are the lifeblood of an economy, but given the changes to bank regulations the sector is increasingly a ‘loser’. In Australia, SMEs employ around 70% of the workforce and produce around 55% of business economic activity. However, two key changes continue to push SMEs out of the bank lending market: 1. Cost – under Basel III, banks must hold higher levels of capital against SME lending, including low-risk loans backed by residential or commercial property. This makes lending to SMEs more ‘expensive’ for the banks, and hence they pass the cost onto the SME borrowers. 2. Time […]

Top-20 banks should be investing in disruptors, says Reinventure co-founder Simon Cant

As Reinventure announces its third $50 million fintech investment fund, co-founder and managing director Simon Cant says its important for big banks to invest in the very startups that are disrupting their industry. The latest fund brings the Westpac-backed VC firm’s total funds under management to $150 million, and follows two previous funds, which have invested in 20 startups. Cant tells StartupSmart that, under its independent venture capital structure, Reinventure is focused on ensuring “our interests are financially aligned with those of the entrepreneur”. Specifically, this third fund will be looking for startups that could be relevant to top-20 banks and their global operations. While Cant says Reinventure will still […]

Open banking already changing the UK market

The launch of “open banking” in Britain earlier this year is prompting the incumbent banks to develop new smartphone apps that give customers a holistic view of their finances. But they face newfound competition from fintechs, telcos and e-commerce giants who see the data-sharing regime as a way of becoming dominant financial services providers in the digital economy. That’s the assessment of the head of Britain’s Open Banking Implementation Entity (OBIE), Imran Gulamhuseinwala, who predicts the regime will result in fintechs flourishing and force a fundamental shift in the incumbents’ retail banking strategies. Treasurer Scott Morrison said last week a similar open banking regime in Australia would be switched on […]

Westpac puts another $50 million into VC fund Reinventure

Westpac Banking Corp has triple-downed on its corporate venture capital fund Reinventure Group, investing a further $50 million into a third fund to bring its total commitment to early stage fintechs to $150 million. A week after Westpac CEO Brian Hartzer described the 20 start-up investments made by Reinventure’s first two $50 million funds as a new “strategic asset” for the bank, Westpac is providing Reinventure co-founders Danny Gilligan and Simon Cant with an additional $50 million to be invested under a more flexible structure. The third fund will consist of a unit trust stapled to an early stage venture capital limited partnerships (ESVCLPs), a new structure that will allow […]

Three disruptive forces driving Aussie neobanks like volt, as fintech startups get serious

There are hundreds of fintechs offering financial services, from budgeting tools to financial advice to loans, but it wasn’t until last week that a start-up was authorised in Australia to offer the product sitting at the heart of banking – deposits. In a significant milestone for the local fintech scene, the Australian Prudential Regulation Authority said last week volt bank would become the first recipient of a “restricted license” under its new regime, created after the federal government indicated it wants to see more competition in banking. In the UK, more than 30 “challenger” banks have been approved by its equivalent regulator since the licensing regime changed there in 2014. […]