Bank customers to expect Netflix-level personalisation

Banking customers will come to expect the same level of personalisation that they are provided by the likes of Netflix and Spotify, Standard & Poor’s has predicted.

Suncorp adds eftpos cash functionality to Apple Pay

Retail bank Suncorp has followed ANZ in adding eftpos functionality to its Apple Pay offering as the tussle to get to the top of consumers’ digital wallets between local and international payment schemes intensifies.

IRESS reaps post-RC benefits

Financial technology provider IRESS has reported a rise in business opportunities within the wealth sector post-royal commission.

Apple Pay: Westpac, NAB have no timetable for implementation

Westpac and NAB customers will have to wait awhile to use Apple Pay, with both banks unwilling to give any indication when they would provide the digital payment option.

Volt bank to build mortgage platform with IRESS

Digital bank Volt has revealed a new partnership with veteran fintech vendor IRESS to build its customer-facing mortgage system.

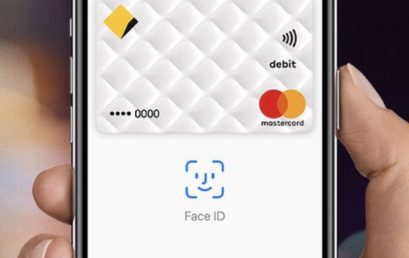

CBA expands Apple Pay to include business cards

CBA said the inclusion of business card holders is part of its drive to become a simpler, better bank with the latest digital offerings.

No more PIN payments as fingerprint-scanning bank cards launch in the UK

Biometric cards which enable people to verify payments using their fingerprint rather than needing to enter a PIN are now being trialled for the first time.