Policies to build a data economy

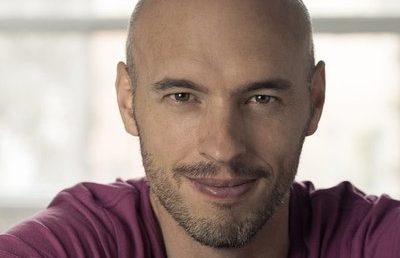

Australia has a rare opportunity to capture a disproportionately large proportion of emerging data economy, according to Reinventure Group co-founder and managing director Danny Gilligan. But the effort is going to take a top-down, nationally coordinated policy effort to build competitive and exportable regulatory frameworks for data. Mr Gilligan holds deeply the belief that data is the single biggest lever for delivering microeconomic and social reform in the next two decades and should be made a material part of policy development and trade considerations at all levels of thinking across both government and the private sector. The potential size of the global data economy is difficult to quantify. There is […]

Commonwealth Bank adds Visa to digital wallets across Google Pay, Samsung Pay, Fitbit and more

After a long wait, Australia’s Commonwealth Bank has today announced they’ve added Visa support across their Digital Wallet solutions. The support for using Visa credit cards and business debit cards comes after Commonwealth Bank saw a large increase in the use of Tap & Pay. The bank saw an increase of 35 per cent to 16.8 million transactions from 5 million Commbank App users over the past six months. It’s not just the Commbank App which gains Tap & Pay support for Visa, with the bank also adding support in Visa to Samsung Pay and Google Pay as well as for customers using fitness watches from Fitbit and Garmin using […]

What’s the deal with equity crowdfunding, and should I do it?

What’s changed? The updated legislation passed on September 12, including an amendment from Labor which means it will come into effect in 28 days. Equity crowdfunding will now be available to private companies, but there are still some restrictions. Companies must have less than $25 million in turnover and gross assets, and funds raised will be restricted to $5 million each year. Startups using the method will also be subject to transaction rules and stringent reporting and disclosure obligations, with annual reports and directors’ reports required. Once companies raise $3 million or more, they will also be subject to auditing requirements. Matt Vitale, co-founder of equity crowdfunding platform Birchal, tells […]

Midwinter integrates with Class

Australian based financial advice technology provider Midwinter Financial Services has today announced its integration with Class, a leading provider of cloud software for administration and reporting of SMSF and non-super investment portfolios. This particular integration will allow users of both Midwinter’s AdviceOS and Class to sync and replicate portfolios from Class into Midwinter’s AdviceOS, and allows users to update portfolio balances in AdviceOS overnight. The integration also allows for Class funds to be prepopulated, updated and used throughout AdviceOS like a normal portfolio. The new integration marks another significant development in Class’ strategy to support advisers in the efficient delivery of advice, enabling effective collaboration across advisers, accountants and their […]

AI, VR and fintech in focus as Microsoft takes on its first Aussie start-ups

Artificial intelligence and financial services based start-ups provide the majority of the first cohort of global tech giant Microsoft’s first Australian accelerator program. The program, known as ScaleUp, was announced in February and targets start-ups that have typically received initial funding and are looking to expand. It promises to help fast-track their growth by linking them with potential customers, Microsoft partners and technical guidance, without giving up any equity. The Australian start-ups selected are Auror, Daisee, FreightExchange, Hyper Anna, InDebted, Kapiche, Karbon, Makers Empire, Teamgage, SimpleKYC, Start VR, VendorPanel and Winimy AI. Many have secured funding in recent times, including virtual data scientist Hyper Anna, which raised $16 million from […]

Basiq and Verrency enable banks to drastically improve the quality of their data

Basiq and Verrency have joined forces to enable banks to store clean, categorised and enhanced transaction data – in real-time, at point of purchase. This will uncover new opportunities for banks to offer their customers innovative, and personalised products and experiences. We are all aware of how ‘unclear’ transaction data can be. Think of how often customers call banks with queries – they have no idea what an item on their credit card statement called ‘HT Willis Brook’ is. You may have heard the term ‘garbage in – garbage out’. If a bank stores unclear transaction data when a customer makes a purchase, this data is then passed downstream to […]

Raiz Invest brings financial insights to life with Facebook chatbot

Raiz Invest, the mobile-first micro-investing platform, has today launched a chatbot to improve the user experience. Customers can ask Ashlee chatbot specific questions about their account or the financial markets and get general customer support. Much like a personal fitness coach, the aim is to help Australians have a healthier relationship with their finances. With an active (paying) customer base of more than 172,000, skewing towards the under-35 demographic, Ashlee provides intuitive and real-time responses. Integrated on Facebook Messenger, it takes advantage of the personal and instant nature of the app in aligning with millennials. Personalised on-demand investment updates Ashlee further personalises the Raiz experience. She will answer personal […]

Aussie banks dragged into the ‘open source’ era via GitHub

Financial policy making is getting the open source tech treatment, courtesy of Data61. The use of GitHub to manage the development of open banking technical standards represents a significant innovation in Australian policy making. GitHub, which is used by 28 million software developers around the world, was bought by Microsoft in June for $US7.5 billion ($10.5 billion). The open banking Data Standards Body, which is being run by the CSIRO’s Data61 unit, is using the online service to manage feedback and comments for the technical standards that will govern the movement of data in the new economy. All decision proposals and final decisions for the open banking standards will be […]