Aus ETFs near $50bn

ETFs were also reported to reach a record in terms of trading value, with more than $4 billion of value traded over the month for the first time.

Apple may be prepping to turn your iPhone into a crypto wallet

Apple is likely preparing to let iPhone owners turn their devices into hardware wallets that allow them to store and use bitcoin and other cryptocurrencies

Visa, Uber and PayPal are reportedly backing Facebook’s Cryptocurrency

The WSJ reports that among those that bought into Facebook’s cryptocurrency are Visa, Mastercard, PayPal, Uber, Stripe, Booking.com and MercadoLibre.

Digital verification moves into the fast lane

From Lakeba Group, the same team behind Ezidox, Verimoto is a digital verification app that is revolutionising the process of financing second-hand cars.

Fintech reshaping consumer behaviour

A recent survey by Bankwest has revealed an unprecedented trend in the way in which fintech in Australia is reshaping consumer behaviour.

Is 2019 still the year of the neobank?

For all the activity going on in the market, there’s still no fully independent neobank offering banking services to the public.

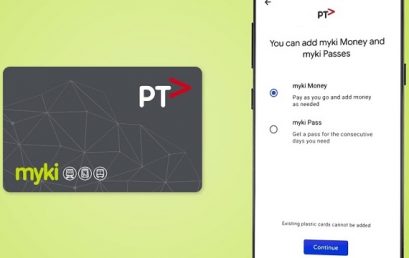

Victorians flock to Google Pay myki alternative

The number of Victorian commuters using Google Pay for public transport is nearing 100,000, just 11 weeks into the state’s new cardless myki scheme.

Uber is pivoting to fintech, something Asian startups have been doing for years

Uber is reportedly making a big push into financial technology. It’s a move that Asian mobility companies have been adopting since at least 2015.