Australian FinTech company profile #43 – Ezypay

Founded in 1996, Ezypay is one of Asia Pacific’s leading subscription payment providers.

NAB wants Android handsets to replace card payment terminals

NAB and point of sale provider Quest Payment Systems revealed a new trial in conjunction with Visa to turn Android handsets into mobile payment terminals.

CommBank will take on Afterpay in buy-now pay-later market

CommBank is moving with the times in a financial market where buy-now pay-later companies like Afterpay and Zip Co have gained traction with consumers.

The financial inclusion and Fintech trends defining 2019

Fintech innovation is disrupting the financial services landscape. The following financial inclusion and fintech trends will help define finance in 2019.

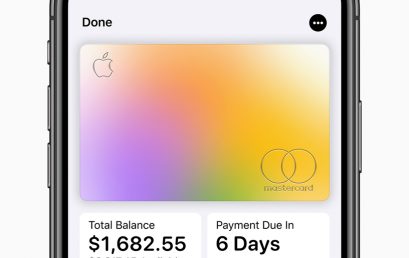

Make room in your digital wallet: Apple Card makes its debut

Apple is rolling out its new Apple Card credit card to appeal to iPhone users while expanding the market for the tech giant’s growing services business.

Unique fraud fighting platform eftsure secures additional $2.5m funding

Australian fintech company eftsure has just secured an additional $2.5 million in funding to accelerate its growth and meet the demand for its protection platform.

Australian FinTech company profile #42 – Yodal

Yodal provides a simple way for advisers to facilitate an efficient, consistent, defensible and reportable Estate Planning service to their clients.

The 4th Annual Australian FinTech Awards – the winners and photos

The fintech night of nights was held last night in Sydney, with the 4th Annual Australian FinTech Awards proving yet again to be the night on the fintech calendar.