Aussie cryptocurrency owners making a profit from their crypto investments

More than three-quarters of Aussie cryptocurrency holders made a profit from their crypto investments over the last year, a survey shows.

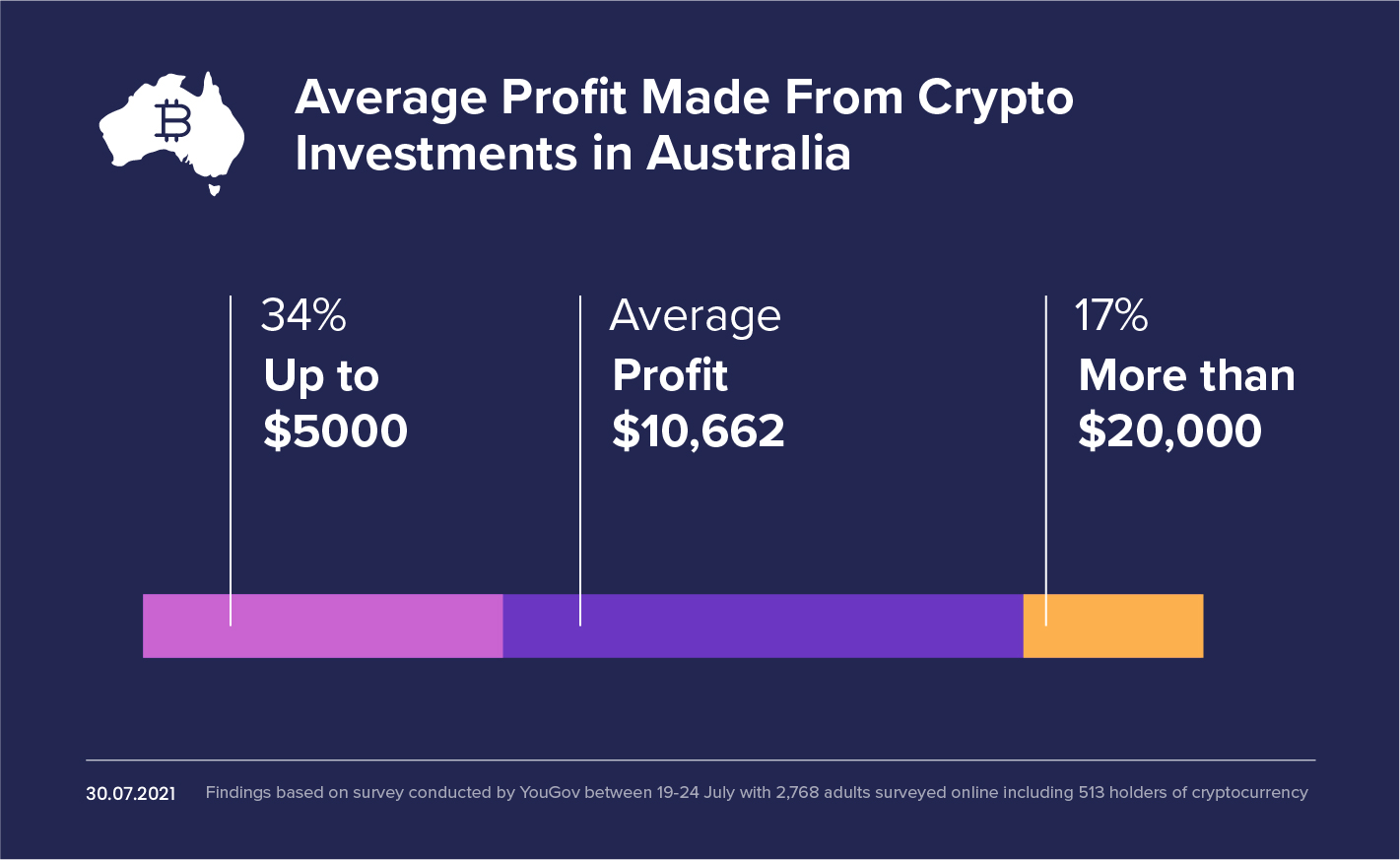

The average profit made by Australians buying and selling cryptocurrencies like Bitcoin was more than $10.5k, according to the YouGov survey. Equivalent to nearly two months of the average Aussie salary.

The YouGov survey was commissioned by Swyftx, an Australian cryptocurrency exchange with more than 320,000 customers. It is the largest survey ever conducted on cryptocurrency in Australia.

Aussie parents with children under 18 at home were the most likely to make money from their cryptocurrency trading, with 86% reporting a profit. On average, they made $12,428.

“The crypto market ran hot over the last year,” said Swyftx Head of Strategic Partnerships, Tommy Honan. “So even though we’ve just come out of a dip in the market we’re still seeing a lot of Aussies reporting profits on their trades over the last 12 months.”

“Aussie Millennials and Gen Xers saw especially big returns, with around one in five (19%) saying they made more than $20,000 over the last year from cryptocurrency. Aussie mums and dads appear to have been especially successful, as well as men in general and crypto users who report a strong or some understanding of the market.”

“A lot of Aussie crypto users are buying and selling relatively small amounts of digital assets, but accumulating pretty significant returns in the process. At the top end of the performance range, we saw around 12% of people make over $30,000 over the last 12 months.”

In terms of location, crypto users in Brisbane were the most likely to report a profit (83%), followed by Sydney and Melbourne (both 76%) and then Perth (68%).

The value of cryptocurrencies like Bitcoin, Ethereum and Cardano have surged over the last 12 months, with the total market capitalisation of all coins rising from USD $366bn (August 10, 2020) to $1.9tn (August 11) this year.

Honan said he expected to see further improvements in the market this year following a market fall in May and June.

“Experienced investors have been buying the dip in the expectation that Bitcoin could hit the USD $100k price by the end of the year,” he said.

“If you are a new to crypto, or want to build your confidence, my main message would be to do your homework on the market before you buy.

“The group who were least likely to report a profit on their crypto holdings over the last year were people who said they had little or no understanding of the market.

“At the moment, this is a relatively small proportion of crypto users in the country, just 16% report having little or no understanding. But for this group and anyone who wants to grow their confidence, it really is essential to do your research.”

“Pro tips are to research the team behind any digital assets you are thinking of buying, and also look at indicators like the size of a coin’s market and its liquidity.”