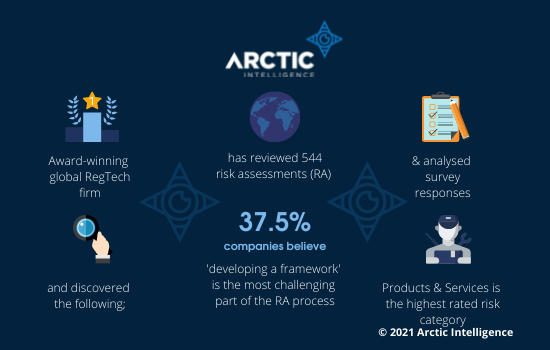

AML Benchmarking report released by multi-award winning RegTech, Arctic Intelligence

Global RegTech firm Arctic Intelligence have released their first Annual AML Industry Benchmark Report to help organisations understand the current state of financial crime risk management. Following a review of 544 risk assessments from their innovative platform, AML Accelerate, and analysing survey data from respondents around the globe, Arctic Intelligence enables businesses to navigate the ever-evolving financial crime landscape with a unique data-set to benchmark against its peers. The combination of quantitative data-driven results and qualitative survey responses provides readers with insights to help them compare and assess their current enterprise risk and develop a pragmatic approach to financial crime. It allows risk and compliance professionals to make improvements to their risk management framework based on the report findings. Based on what we know, 37.5% of survey respondents identified ‘developing a framework’ was the biggest challenge in conducting risk assessments.

Arctic Intelligence is a privately-owned company that has won numerous awards since launching its solutions and has built an international partner eco-system to support multilateralism. AML Accelerate launched in 2018 and has since evolved into a proven enterprise-wide risk assessment solution that has guided hundreds of businesses to compliance across the globe. With continued product innovation to support businesses of all sizes and complexities, Arctic Intelligence purpose-built financial crime solution can alleviate the challenges that come with the risk assessment process.

Rosie Davitt, UK Lead at Arctic Intelligence said, “Our report survey found almost 1 in 4 companies identified rolling out and management the process across teams another challenging aspect of the risk assessment. This seems to correlate to the same number of respondents who take 3 to 6 months to complete their assessment. Two significant factors that RegTech helps to solve for.”

The adoption of RegTech is undoubtedly making headway as regulators strengthen their enforcement which come with big price tags. Although the risk assessment process can be challenging, AML breaches and non-compliance is costly. 69% of respondents claimed that digitisation had provided a least two significant improvements to the risk assessment process. These include more effectiveness in understanding AML risks and demonstrating compliance, as well as having more confidence in their risk assessment process with a centralised documentation repository.

Arctic Intelligence CEO Darren Cade adds, “The enterprise risk assessment is the cornerstone of any strong financial crime compliance program. Financial crime compliance and risk professionals manage the risk assessment process across their organisations, often involving many stakeholders, and report their findings to the Board of Directors and regulators. Board Directors are ultimately accountable for anti-money laundering frameworks and generally look to get assurance from the organisation on the process followed to reach the conclusions presented and how the results compare with other similar organisations or industry peers. This report seeks to provide insights and benchmarking to help provide that assurance.”

Arctic Intelligence’s AML Benchmark Report delivers the insights into the challenges of the risk assessment process and helps businesses identify areas of improvement. It can also help to flag common considerations and findings that other companies adopt as they mature in their financial crime risk management regime. After what appeared to be an insurmountable year, the 2021 AML Benchmark Report is indicative that Arctic Intelligence’s philosophy of providing greater transparency and accountability for organisations continues to materialise.