Banks show no interest in unconditional love for savers: Mozo

Savers are being short-changed. Mortgage repayments keep on rising, but people are unable to lean on their savings accounts for support when it comes to finding the extra cash.

Mozo found mortgage repayments and groceries prices are causing the most financial stress

Recent research from Mozo found almost two thirds (64%) of Australians are worried or extremely stressed and anxious about the cost of living.

APP-Y NEW YEAR – Mozo’s top four fintech tips to help keep your financial resolutions on track

Sticking to financial resolutions can be tricky but there’s fintech apps that can help unlock possible savings and track your expenses.

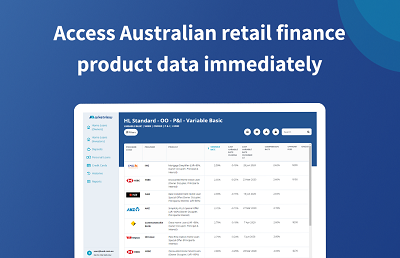

Mozo launches digital banking intelligence tool – Marketview

Marketview has successfully helped numerous Fintechs and banks take charge of how they operate, by focusing on the insights rather than the data gathering.

Nearly half of Buy Now Pay Later users have stopped using their credit cards – Mozo

New research from Mozo.com.au has found that nearly half of all Buy Now Pay Later users have either cancelled or stopped using their credit cards.

Have we seen the home loan peak?

The Reserve Bank of Australia paused its rate rise campaign in April, although the Bank’s Governor has signalled he is just drawing breath. But there may be some hope on the horizon for homeowners.

RBA keeps interest rates on hold – fintech leaders react

The Reserve Bank of Australia (RBA) has this month kept interest rates on hold following 10 straight increases.