With inflation soaring, fintech company CashD redefines pay cycles for employees

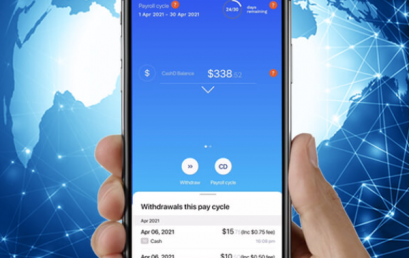

CashD is redefining pay cycles, by enabling businesses to empower their employees to choose how and when they get paid.

Australian FinTech company profile #126 – CashD

CashD is redefining pay by enabling businesses to empower their workers to choose when to get paid.

CashDeck app Wealth Desk is a game changer for mortgage brokers

CashDeck have released their Financial Fitness Tracker app called Wealth Desk for Apple and Android and it’s set to be a game changer for the 65% of mortgage brokers who find marketing and lead generation a challenge. The app is a simple tool that helps clients prepare for the lending process. But, for the broker, it acts as a sales tool, an ice-breaker, a database builder and a way to get their business onto thousands of smartphones. “Twelve months ago we set ourselves three goals”, said Owen Joyce, CashDeck’s Chief Commercial Officer. “One, build an app that is useful to its user in less than two minutes after they download […]

CashDeck releases API, integrates with Ezidox

CashDeck, one of the leading platform providers that helps borrowers quickly and securely provide their bank statements and at the same time, generate a detailed income and expense analysis based on the borrowers’ actual transactions, today announced they have opened up their platform capability with an API. As part of this move, CashDeck is aligning the platform with Ezidox, Lakeba’s well known software solution for document collection and management. The CashDeck app is currently used by more than 700 broking firms and boasts a high satisfaction rate with both brokers and their clients. It helps lenders, aggregators, brokers and software developers simplify the process of accurately analysing living expenses. Wayne […]

CashDeck releases software to help brokers and borrowers prepare for tougher lending measures

There’s no doubting that the Hayne Royal Commission will bring about changes to the way borrowers, brokers and bankers behave. As lenders are required to more carefully scrutinise loan applications and living expenses, it is expected that home buyers borrowing power will be greatly reduced. A recent UBS report suggests that credit availability could be cut by 21 to 41%, depending on income. While nobody can tell exactly what measures will come about, change is certain, and smart brokers will already be making changes to their business processes. Compliance will be top of the list, and for brokers this will mean more accurately assessing living expenses—an onerous task. Technology must […]

CashDeck and MyMoney partner to educate on wealth management

CashDeck today announced that it has signed an agreement with MyMoney to provide personal wealth management software and financial education to over 1000 of MyMoney’s clients. The partnership will help MyMoney’s clients better understand their spending habits, allowing them to know at any given time what their money is doing. Graham Chee, Founder and CEO of MyMoney, a business that specialises in financial service solutions for self-directed clients, said he has recognised a noticeable shift in client behaviour in recent years. “Where once clients left everything in the hands of an adviser, these days they want to be across their finances and take more responsibility for their outcomes alongside their […]