86 400 partners with OCR Labs to streamline broker and customer experience

Australia’s first smartbank, 86 400, is continuing its acceleration in the mortgage space, implementing a new identity system from Australian fintech, OCR Labs to further streamline both the customer and broker experience, and provide added security enhancements using biometrics.

Since launching mortgages in November 2019, 86 400 has continued to develop its market-leading home loan application and approval process, addressing both broker and customer pain points simultaneously to offer a streamlined experience.

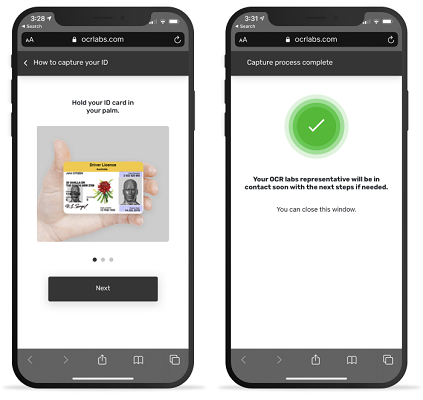

The partnership with OCR Labs provides 86 400 customers with a new, simpler, contactless Verification of Identity (VOI) solution which they can complete straight from their smartphone in as little as two minutes.

All Australian property transactions require applicants to verify that they are a real person. Traditional processes require applicants to meet face-to-face with their broker or book a courier to meet at the customer’s residence to confirm their identity, while VOI for 86 400 customers can now be done virtually, in just minutes and from anywhere. Applicants are guided to take a photo of their ID documents, check their data has been captured correctly and then take a selfie with liveness detection to confirm their identity.

Will Ryan, CCO at OCR Labs said, “86 400’s innovative approach to mortgages is transforming the way Australians purchase and refinance properties. Our latest biometric technology now plays a key part in 86 400’s home loans application process, verifying the identity of new mortgage customers securely and with ease.”

Robert Bell, CEO at 86 400 said, “We’ve kicked off 2021 as we mean to continue – with a slew of smart features already in production and partnerships in planning. OCR Labs is the first cab off the rank this year, providing our customers with a market-leading banking experience that’s smart, secure and convenient, underpinned by the very best home-grown Australian technology.”

“Our focus is on continuing to streamline the application and approval processes, making it even easier for brokers and customers to do business with us. After breaking our own records for home loan applications in November and December, our aim is to build on this momentum, ensuring even more Australians now have the opportunity to save thousands on their home loan.”

The smartbank’s home loan products (Own and Neat) are now available to more than half of Australia’s brokers, with over $330m in home loans settled and awaiting settlement.

This announcement follows a successful pilot of OCR Labs’ technology in the 86 400 call centre late last year.