Xinja Bank receives full banking licence from APRA

Xinja Bank was today granted a full banking licence, and opened bank accounts to early customers: the first transaction accounts from an independent, 100% Australian neobank.

The Australian Prudential Regulation Authority (APRA) said today it has granted Xinja its full banking licence. Xinja Bank is 100% digital and designed for mobile. It plans to shake up Australia’s old-style bank sector.

“It’s enormously exciting that Australians have a new, independent bank,” said Chief Executive and Founder, Eric Wilson. “It’s time Australia’s very old banking model was disrupted.

“We are 100% digital, and we want people to have a real alternative to the incumbent banks. We want to give customers a real choice to be able to be with a bank that looks after them.

“From today, we’re rolling out bank accounts to customers.”

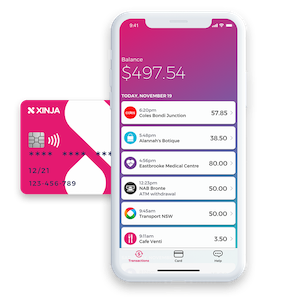

Xinja Bank has launched transaction accounts today – which are accessed solely via the new Xinja app and come with a Xinja Debit Mastercard® – and will soon launch ‘Stash’, or savings accounts. It plans to add lending products in the first quarter of 2020, “as well as some other fun, ‘unbanky’ surprises,” Mr Wilson said.

It has had customers on board and products in the marketplace since 2018. It has distributed more than 12,000 prepaid cards, which are in use on average in 17 countries per day, and over 28,000 people have already signed up for Xinja. Existing prepaid card customers and those already on the waitlist will be the first to get access to Xinja’s new bank accounts.

Xinja milestones

- Xinja launched in May 2017

- Xinja is the first independent Australian neobank with products in the market; the prepaid card, app, and bank accounts – the latter launched today

- Xinja has raised more than $5 million in two record-breaking equity crowdfunding campaigns in January 2018 and January 2019

- Xinja raised a further $45 million from private and institutional investors around the globe

- Xinja is the only 100% cloud based bank in Australia & deployed world-leading cloud based banking technology in record time

Xinja is built on new technology designed for flexibility; a platform that will allow it to rapidly roll out additional services to customers, driven increasingly by the dynamic use of data.

“This is what banking should be,” Mr Wilson said. “Hyper-personalised services that leverage customers’ data in their interests.”

Having zero legacy systems and state-of-the-art technology gives Xinja Bank a massive advantage over both traditional and Australian digital banks. “We don’t have bricks and mortar branches or old technology that we are constantly patching to meet the needs of customers,” Mr Wilson said. “Our costs will be significantly lower than traditional banks.

“But it’s not just about technology: our purpose is to help people make more out of their money and get out of debt faster. And if we stick to that, we will succeed. We’ll use technology and data to prompt money mindfulness; nudging people toward better every day behaviour that can improve their finances.”

US-based banking futurist and advisor to the Xinja board, Brett King, said consumers who are engaged, or ‘nudged’ by banks using sophisticated digital platforms, into better financial behaviour, have increased their savings by between 4% and 8% per month.

“We are going to see hyper-personalised, data-driven messaging, products and services that help people achieve their financial goals,” Mr Wilson said.

Mr King also recently told a banking technology seminar in Melbourne that banks that use new technology to help their customers, retain those customers. Attrition rates are around 0.5%, compared with 3.8% for a control group, Mr King said.

“We know that if we do the right thing by our customers, they will stick with us, and recommend us to their friends,” Mr Wilson said. “I know we will make less money from our customers than traditional banks,” he said. “We are fine with that. Our key performance indicators at Xinja Bank include ensuring our customers do better. And that’s an important difference between us and our competitors.”

The Xinja Bank app is easy and intuitive to use, colourful and fun. “Banking has been boring for too long. We fundamentally believe that if you make managing your money engaging, people will get better at it,” Mr Wilson said.

Xinja Bank is shaking things up in other ways too: its ‘ten golden rules’ include making money but (rule #4): “we don’t lie to our clients in person or in marketing. If our grandmother would think it was wrong, then it is. We aim to make lots of money ethically and we are proud of it.”

Xinja won’t offer credit cards because the only way to make money “… is when your customers make poor decisions,” Mr Wilson said.

“We also want to reward people who stick with us. That turns the current model on its head – the existing banking model offers higher saving rates to new customers but ignores those people who have been loyal.

“We also hope to be able to use data for risk assessment that allows us to offer better lending rates for good financial behaviour.”

Xinja was granted a restricted banking licence in December 2018, and worked with regulators to meet stringent requirements to obtain its full licence. “This has been an incredibly thorough process,” Mr Wilson said. “We have been really busy building the best systems, to the highest standards authorities rightly set, to get our bank up and running.

“And we have been in constant contact with our customers and investors, many of whom have been on board since the beginning, when all we had was a solid idea about what we wanted to deliver in banking and a bunch of slides to explain it. Our customers have helped us develop, define and refine what we offer.”

The Xinja team has grown to around 65 permanent staff, guided by a board that includes advisor Jason Bates, co-founder of UK neobanks Monzo and Starling; Thomas Vikstrom, a former leader of Tesla’s engineering team, and Brett King, who is a former advisor to the US Obama White House on the future of banking.

Speaking from the US, Mr King said: “It’s wonderful to see Xinja delivering on its promise and continuing to lead the Aussie challenger bank pack.”

Mr Bates said: “I have every confidence Xinja will follow in the footsteps of the neobanks that are changing the face of banking in the UK and Europe.”

Xinja Bank fast facts

- Sept 2019 APRA grants Xinja Bank a full bank licence

- Sept 2019 Xinja Bank launches bank accounts with ‘Stash’ (savings) account coming soon

- Jan 2018 and Jan 2019 Xinja raises $5 million in equity crowdfunding

- Nov 2018 appoints Thomas Vikstrom, former leader of Tesla’s engineering team to board

- Oct 2018 Brett King, futurist, best-selling author and adviser to Obama White House on banking, joins as advisor to Xinja Board

- Feb 2018 Xinja launches app and prepaid travel card, used in 17 countries each day on average with zero ATM or currency conversion fees