Will banks place a game engine at their core?

Deloitte just provided an insight into the answer. According to their new 2021 Banking trends report, nine out of ten chief marketing officers now expect to compete mostly based on customer experience. Given that 73% of consumer interactions with banks are digital, the only way this happens is through smart use of technology and data. The report concludes by stating that banks should leverage artificial intelligence (AI) and machine learning (ML) with platforms to collect data signals, identify moments and deliver against them in a personalized, relevant and meaningful way.

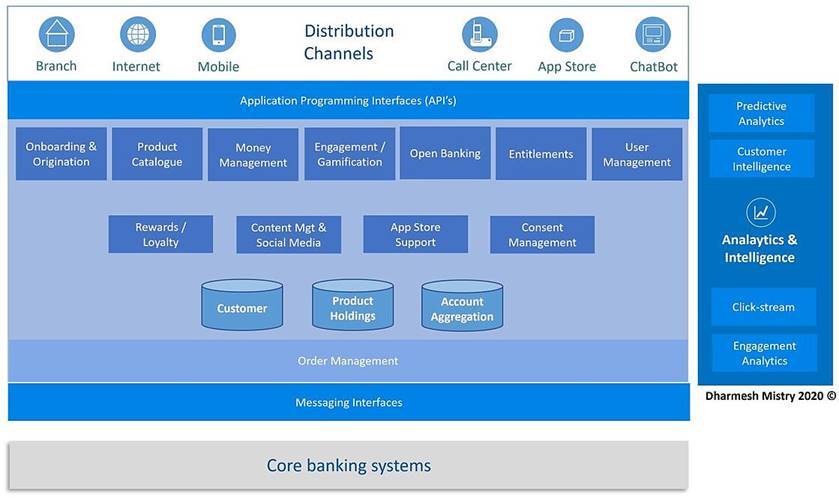

Game Theory is the best way we know of to engage people on journeys. It’s why we get hooked on games, compelled to compete, have fun, master and build emotional connection. Dharmesh Mistry, ex Chief Digital Officer at Temenos and respected Fintech commentator and leader gets this in his recently published modern banking platform. Smack bang in the middle is Engagement, driven by game, a platform that Moroku has, integration and API ready.

Banks will place game engines at their core to drive engagement because it is the number one priority and game is the best way of solving it.