Why straight-through processing, with AI and ML, should be top of your transformation agenda

Straight-through processing (STP), powered by artificial intelligence (AI) and machine learning (ML), isn’t just going to take the manual element out of loan applications. It’s going to help us turn open banking into an opportunity, it’s going to personalise customer interactions and shape banking strategy well into the future.

Poli Konstantinidis, Sandstone Technology’s Executive General Manager, Origination, AI and ML, talks us through what needs to change before we get there.

Reality versus the dream

The reality of loan processing for financial institutions looks very different to the ideal. As Poli Konstantinidis explains, the preparation for a typical loan application today, and the supporting verification, can take up to 60 minutes.

“A living income and expense assessment based on paper-based bank statements can take up to 2 hours, according to our analysis,” states Konstantinidis.

That’s because in the average end-to-end loan origination process, multiple processing teams handle different stages, from application preparation, underwriting, income and expense assessment to the verification of documents. Human intervention at multiple touchpoints, especially in relation to document processing, is plagued by double handling and prone to errors.

The impact on employees and the customer

For the bank employee, many parts of the application lifecycle and the day-to-day tasks associated with those, can feel monotonous and robotic.

But ultimately, the bank’s customer bears the brunt of this slow, manually intensive process, Konstantinidis says. Delays in processing mean a slower time to full approval, or to getting the credit or funding they want, and that has a real negative impact.

“In the worst case, it impedes the customer’s experience in their home-buying journey,” Konstantinidis says, “which as we know is one of the most significant and emotional events of their lives.”

And customer service expectations are only going to rise. The last 18 months have accelerated demands for certainty, and a seamless, frictionless credit experience.

Poor customer experience can cause dropouts in applications, and reduced retention.

Maintaining highly manual processes also keeps the cost to serve high, and as more pressure comes to bear – through margin squeeze, low cash rates and more – the net interest margin that banks are working with, particularly on retail lending, is getting smaller and smaller.

AI and ML to the rescue

This new generation of banking technology will enable STP with no human intervention, which is the holy grail for the industry, both from the bank side and the consumer side. “We will see complete end-to-end electronic financial transactions, from data capture at the initial point of application all the way through to fulfilment and settlement of the loan,” says Konstantinidis.

“Advanced banking technologies will perform functions that humans, frankly, won’t have the facilities or capabilities to perform,” states Konstantinidis.

Automated processes will ensure data integrity, identify anomalies in data, and alert banks to potential fraud or unqualified data. Regulatory and compliance changes will be enforced at an AI level, which can significantly reduce compliance gaps and risks.

Cost efficiencies and operational process efficiencies will reduce the end cost of an application. Sandstone’s intelligent document processing tool DiVA, as an example, can automate up to 80% of some processing tasks, from automatic classification, redaction and rotation, to the splitting of data, date range recognition and missing information requests. It also ensures AI enforced rules and configuration.

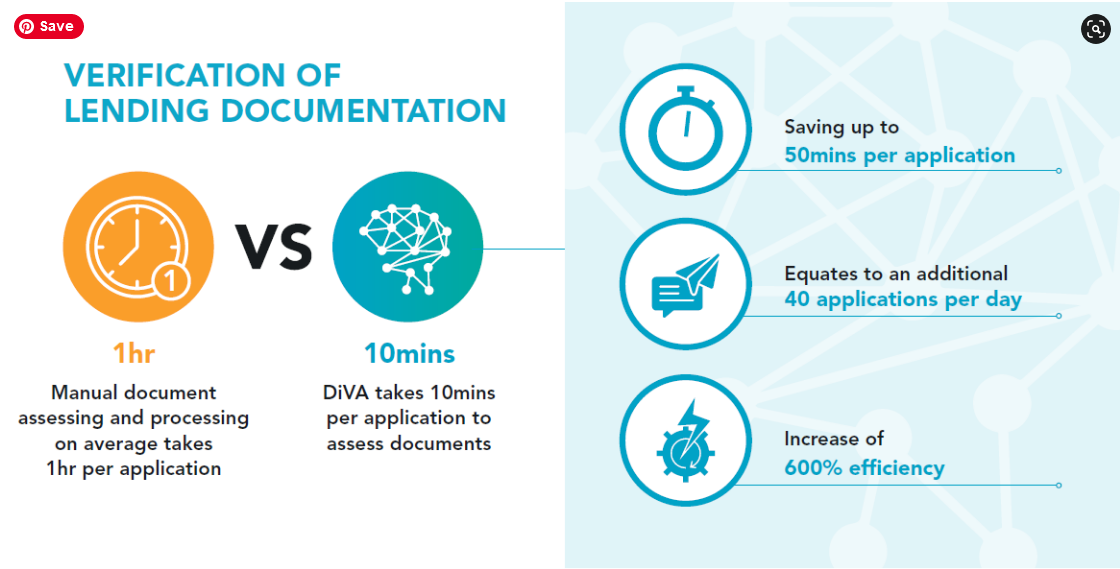

With document verification, Sandstone analytics show that DiVA can reduce the average touch time from one hour to 10 minutes. For the transactional use case, DiVA can save 1 hour and 50 minutes per application, representing a 1,200% efficiency increase.

Importantly, organisations will be able to better manage their two key, competing priorities: higher standards set by the regulator around better and fairer credit outcomes for the consumer; and increased consumer awareness and empowerment dictating how and when they want to be serviced.

What’s holding up the adoption of AI and ML

In many geographies, the adoption of advanced banking technology for loan processing, including AI and ML, has been fast-tracked by regulatory moves to open up data sharing. In the UK where open banking has been a fact of life for up to two years, many banks have a far more evolved approach to STP than in Australia.

But more than just regulatory obligation, it’s also about business maturity, Konstantinidis says.

“It’s the understanding that gives the appetite to want to take on these processes. And it’s organisations adopting AI and ML as early as possible in their transformation programs, which helps them gain a more mature understanding of AI’s capabilities, and applicability to their business,” he says.

What the future of loan processing looks like

When combined with the staged adoption of open banking and regulatory changes around Consumer Data Right, STP, AI and ML are going to enable enhanced levels of responsible and compliant banking automation and personalisation. As banks cross validate with open APIs, they will be able to issue loans to customers at a much greater speed, in a way that allows for personal information to be redacted, documents to be rotated, indexed and interpreted, with greater accuracy and increasingly less manual processing.

This is the time to innovate, Konstantinidis says; to start interpreting customer documents, unlocking intelligent insights, which can be made available and fed into other parts of the bank’s process.

That can be done not just from a retail, but from SME and commercial lending perspectives.

When it really gets interesting

According to Konstantinidis, it’s at this point of AI and ML adoption where we can really start to engineer more personalised and tailored conversations with customers. These might include financial wellbeing prompts or product recommendations, based on an individual customer perspective or at the industry level. Banks can give customers access to relevant information as they go through all the touch points of their credit journey.

“AI and ML are driven by data which will power that personalisation, opening up communications with the customer, at the right time, in the right tone, in a way that makes sense for the individual.” Konstantinidis says.

“Data, combined with AI and ML, are really going to become the key sources to shape banking strategy going forward.”