Track UK mutual funds with Sharesight

Did you know that Sharesight allows investors to track more than just stocks? In addition to support for mutual/managed funds in Australia, New Zealand and Canada, Sharesight tracks the price and distribution information for over 12,000 mutual funds in the United Kingdom, one of more than 30 global stock exchanges and mutual funds that we support.

Sharesight has fund data from Morningstar dating back as far as 1 January 2000, with prices updated daily by end-of-day, UK time – making it easy for UK investors to track the performance of multi-asset investment portfolios in a single place.

What is a mutual fund?

Mutual funds give investors access to a diversified collection of stocks and/or bonds across a range of sectors and markets in a single fund. Mutual funds offer scale, diversity, reduced risk and less exposure to market volatility than investing in a single company or industry would, making them appealing to investors looking for a convenient and professionally managed product.

The main advantages of mutual funds include:

- Managed by professionals: Funds are managed by experts who regularly monitor the fund’s performance

- Diversification: Investors can spread their money across a wide range of investments, with tailored products that correspond to different investing strategies, assets and risk tolerances

- Affordability: Investing in a managed fund is more cost-effective than investing in a basket of individual stocks

Mutual funds have historically been a popular choice in the United Kingdom, with these investors preferring funds that prioritise outcome and allocation, as well as Targeted Absolute Return.

UK mutual fund support in Sharesight

Sharesight supports all UK mutual funds covered by Morningstar price data — over 12,000 — which will continue to grow as additional mutual funds enter the market and are included in the Sharesight database.

As users add UK mutual fund investments to their portfolios (details below), they can get the full picture of their investment performance by viewing their fund investments with the rest of their holdings, whether they be stocks, ETFs or even custom investments such as property or term deposits. This makes it easy for investors to see the impact of specific investments as part of the overall return of their portfolio.

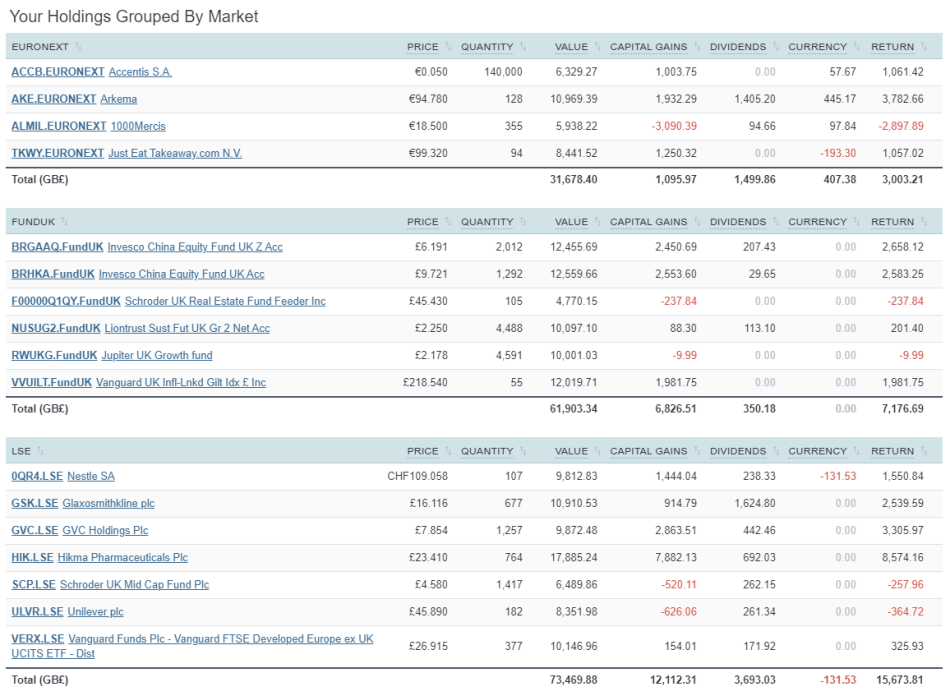

Sharesight’s Portfolio Overview page showing portfolio performance broken down by market

How to track UK mutual funds in Sharesight

- Sign-up for a FREE Sharesight account.

- Add your holdings to your portfolio(s) by searching for the fund’s code or name in the FundUK market. Or by using the Sharesight File Importer to bulk import trades to your portfolio.

- Sharesight converts the prices and valuations of your holdings from their listed market to your portfolio’s base currency. It also automatically calculates any currency fluctuations on a daily basis and backfills past distributions (and continues to add new ones as they are announced).

To read more, please click on the link below…