Regulation alone won’t solve financial advice woes

By George Lucas, chief executive of Raiz More regulation will be the most likely result after the Hayne royal commission hands down its final report. But is this really the answer? When then financial services royal commission hands down its final report by 1 February 2019, it’s odds-on it will call for more regulation. And the government of the day will duly oblige, rightly fearing the political fallout if it fails to implement the report’s recommendations in the wake of the malevolent behaviour being unveiled. The legislation will pass the Parliament, giving the regulators more power to keep the top end of town in line. And the regulators, whose reputations […]

Gen Z using tech to become finance savvy

Young people are using money in ways unheard of a generation before. They have never known a card that doesn’t tap and go, or a phone that can’t control every aspect of their financial lives. While many pass off Gen Z as just an extension of the “smashed avocado” generation, some commentators say they have a very different mindset to Gen Y and are more savvy about how they spend and invest money. Dale Gillham, executive director and founder at Wealth Within, a financial services and education company, says: “A few years ago nobody under 30 would talk to us to much,” he says. “Now we’re finding that under 25s […]

Recent political turmoil causing millennials to spend less

New research by Raiz Invest, the mobile-first micro-investing platform, shows the recent political climate has made millennials more financially risk averse, with almost half (44%) spending less than six months ago. An even greater proportion (48%) considering changes to their investment strategy. More than 1,000 young Australians were asked about changes in spending and savings habits, as well as trust in major institutions around personal finances – including superannuation, savings and investment funds – to uncover the impact of these major events on their behaviour. Australians are feeling disillusioned No surprise that nearly one in three (29%) mistrust their financial institutions with their superannuation, with a third (34%) remaining neutral. […]

Fears simmer about repeat of Storm Financial fallout

One fintech firm fears that the political reaction to the Hayne royal commission will result in more ineffective reforms, similar to the ones arising from the collapse of Storm Financial crisis. Raiz chief executive George Lucas said that when the royal commission hands down its final report by 1 February 2019, the odds are that it will call for more regulation. The government of the day will duly oblige, said Mr Lucas, rightly fearing “the political fallout if it fails to implement the report’s recommendations in the wake of the malevolent behaviour being unveiled”. “The legislation will pass the parliament, giving the regulators more power to keep the top end […]

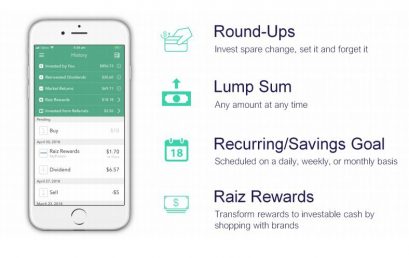

The app increasing your super while you spend

A new phone app is helping people get big returns on their retirement savings, and Nine News has revealed how you can start earning NOW with as little as five dollars. A new app called Raiz is helping consumers use their spare change to boost retirement savings through an easy-to-manage investment account. And former financial advisor Nathan Martyn said he has already saved hundreds. “I wanted to start paying attention to where my super was and how it was likely to generate over time,” Martyn told Nine News. Say Martyn uses his debit card to buy a coffee for $3.50, the figure is rounded up to the nearest dollar. In […]

SendGold platform brings real assets to digital currency

SendGold, a Sydney based fintech company with an asset-based peer-to-peer digital money platform, has launched an equity crowdfunding campaign to raise $2 million. SendGold is hyper-liquid, hyper-accessible, and based on physical gold, one of history’s most reliable assets. SendGold is an alternative to bank money as it allows its customers to save, invest, gift and pay using gold. The SendGold technology platform is highly scalable and its business model addresses some of the largest markets in the world, including not only gold, but payments, gaming and rewards, targeting Asia’s fast-growing and increasingly wealthy middle class. SendGold CEO and co-founder Jodi Stanton said, “We believe the world’s current money systems are […]

The winners of the 3rd Annual Australian Fintech Awards

The Australian fintech sector gathered in Ashurst’s Sydney offices on Wednesday 1 August to celebrate the 3rd Annual Australian Fintech Awards. The firm hosted and sponsored the awards, which celebrated the achievements and successes of the people and businesses comprising the Australian fintech sector. The keynote speaker at the awards was The Hon. Scott Morrison MP, Treasurer, Federal Member of Cook. Ashurst sponsored the major award of the evening, the Fintech Startup of the Year, which was awarded to Trade Ledger, the world’s first business lending platform that transforms digital data from supply chains in real time. Ashurst partner Tim Brookes (Digital Economy) commented: “We are delighted to have hosted […]