ASIC expands Australia’s regulatory sandbox regime for FinTech start-ups

ASIC’s regulatory sandbox regime for FinTech products allows eligible businesses to test particular financial services or credit activities.

Crowdfunding as a game changer for SMEs

Crowdfunding and the new equity rules have the potential to be a game changer for Australian proprietary companies.

The changing face of financial advice

Open banking platform Basiq and CRM software provider AdviserLogic have partnered to solve this issue and improve the way financial advice is given.

Fintech unicorn rewrites forex rules to snag big bank profits

The struggles of a speciality coffee shop run by two budding entrepreneurs in Melbourne lie behind the success of Airwallex, Australia’s newest unicorn.

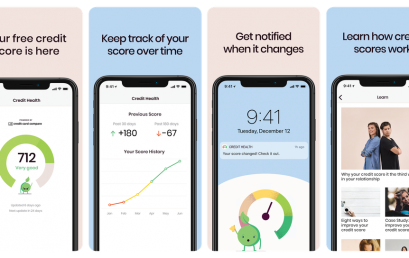

Introducing Australia’s first credit score tracking app

In an Australian-first, a credit score app has been developed to give consumers more access than ever before to their personal credit score.

Protecting cryptocurrency wallets from digital thieves

One way in which cryptocurrency wallets aren’t like conventional wallets is that cryptocurrency wallets can be hacked.

BGL releases Simple Fund 360 integration with Australian Money Market

BGL Corporate Solutions, Australia’s leading supplier of SMSF administration and ASIC corporate compliance solutions, is proud to announce that Simple Fund 360 now has an integration with Australian Money Market, a secure online term deposit & cash investment platform. “We’re thrilled to have Australian Money Market as part of BGL’s Ecosystem”, says Ron Lesh, BGL’s Managing Director. “Australian Money Market Pty Ltd (AMM) is an online Term Deposit platform which allows you to compare and choose Term Deposit interest rates from more than 25 Australian financial institutions. AMM streamlines the administration of investing in term deposits online, saving you time and reducing admin costs. With AMM you can see all […]

Super will help fund the next wave of unicorns

The country’s leading venture capitalists are tipping more direct investment will flow from superannuation firms such as Hostplus into start-up deals, as more $100 million-plus raises test the funding capacity of the VC firms. Last week cross-border payments start-up Airwallex became the latest Australian company to achieve the lauded $US1 billion valuation milestone, making it the quickest local start-up to achieve unicorn status. The valuation came on the back of a $US100 million raise ($141.3 million) for the fintech, which is less than four years old. The raising was led by US investor DST Global, with participation from Sequoia Capital China, Tencent, Hillhouse Capital, Gobi Partners, Horizons Ventures and Square Peg […]