Revolut launches Stock Trading in Australia

Revolut, the global fintech company with more than 18 million retail customers worldwide, has added its popular Stock Trading feature to its Australian offering.

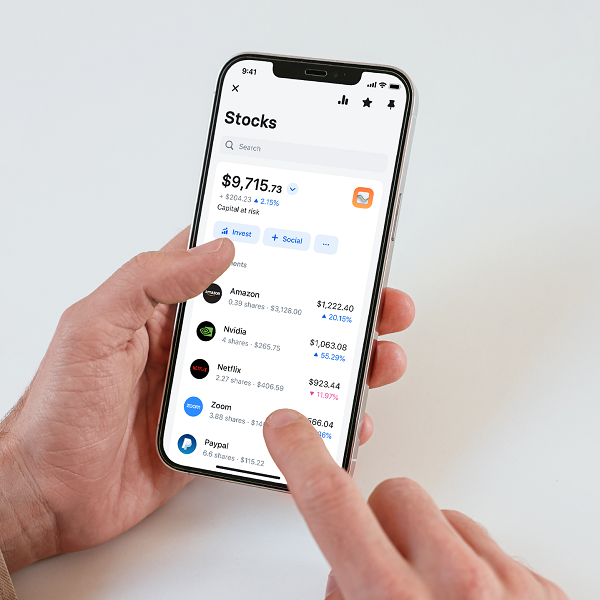

Australian Revolut customers now have the opportunity to buy and sell fractional shares listed on the New York Stock Exchange (NYSE) and NASDAQ through the Revolut app. The feature allows customers to invest as little as US$1 into stocks from popular listed companies such as Amazon, Tesla, Coca-Cola, and Netflix.

To mark the launch, Revolut Australia is waiving all commission fees for the rest of the year to anyone who uses the Stock Trading feature by June 30, 2022.

The Stock Trading feature includes real-time market data, intuitive stock charts, as well as price alerts, market graphs, and global market news within the app. The in-app platform also includes

Revolut’s social trading feature, which will allow traders to share their portfolios and view the investments of other Revolut customers.

By providing customers with access to an abundance of market and security information at their fingertips, Revolut aims to empower traders to make more educated investment decisions.

“We’re really excited to be offering Stock Trading to our Australian customers, and simplifying the trading experience for both new and experienced investors,” said Matt Baxby, CEO of Revolut Australia.

“There are so many barriers for Aussies who want to invest in the US stock market. Traditional providers sting customers with a whole slew of hidden fees including brokerage, markups on foreign exchange into US dollars, as well as deposit and withdrawal fees. By offering commission-free trades and our market-leading FX rates, our stock trading feature sets out to simplify things and give investors more money on their trades, and less on fees.”

Revolut has more than 100,000 Australian customers since it launched here in August 2020, and has been rolling out new services for Australian customers at a rapid pace. Revolut Australia currently offers a multi-currency transaction account, automated budgeting,

international remittance, a cryptocurrency and commodities exchange service, shopping rewards, a donations platform, and linked Junior accounts for children aged 6-17.