Digital fintech disruptor launches intelligent loan marketplace

LoanOptions.ai is Australia’s most intelligent loan marketplace. LoanOptions.ai uses artificial intelligence to provide customers with the most competitive loan options in one place.

Founded by Julian Fayad, one of Australia’s most innovative fintech entrepreneurs.

Julian is a partner in multiple other successful businesses. He has proven himself as one of Australia’s most innovative entrepreneurs in the fintech industry.

After growing up with a natural gravitation towards technology, Julian designed and built an app at the age of 18. He successfully worked his way through the ranks in the financial sector, working in high level management roles, where he continuously brought record-breaking growth and developed numerous key partnerships among the broker and lender space. He launched LoanOptions.ai, Australia’s first AI powered comparison tool in 2020.

Julian says, “I have been working in finance and business for almost a decade. After spending time building and scaling other businesses in the financial industry, I decided that it was time for me to create and build my own business. I want to fully execute my vision by blending my knowledge of both finance and technology and I am grateful to be able to implement my skills in these areas in the business each and every day.”

Julian is passionate about being a digital disruptor in an industry that is generally a slow mover in adapting to the newest trends, and LoanOptions.ai will be the main beneficiary of this.

Julian offers his staff a fun, interactive workplace (racing simulators,PS5, Gym Facility and an indoor heated swimming pool to unwind at the end of a busy day) and flexible work hours.

Julian adds, “Even before the pandemic, I always believed in offering people flexible working situations that are earned through trust. Our software allows us to operate from anywhere in the world, securely and without any issues. Our business is highly collaborative and fully integrated. Most employees choose NOT to work from home because what we have created is an office environment that breeds enthusiasm, fun, high performance and a great work life balance. The option to work from home or the beach is always there and every now and again we spend the day outside of the four walls (we have worked from a boat all day a couple of times).”

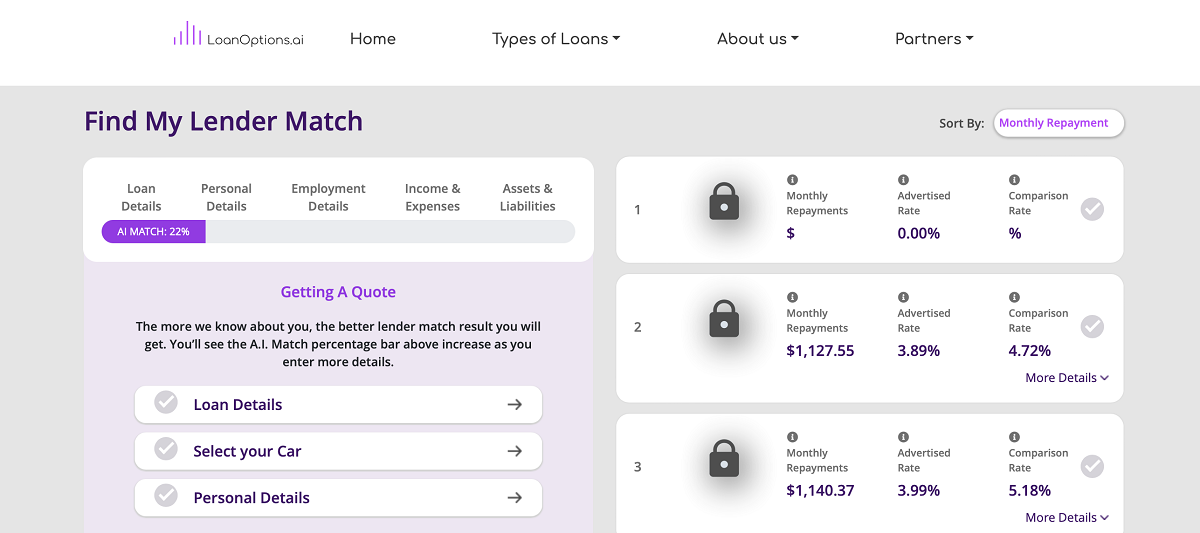

LoanOptions.ai helps customers to navigate the best loan rates from over 60 lenders.

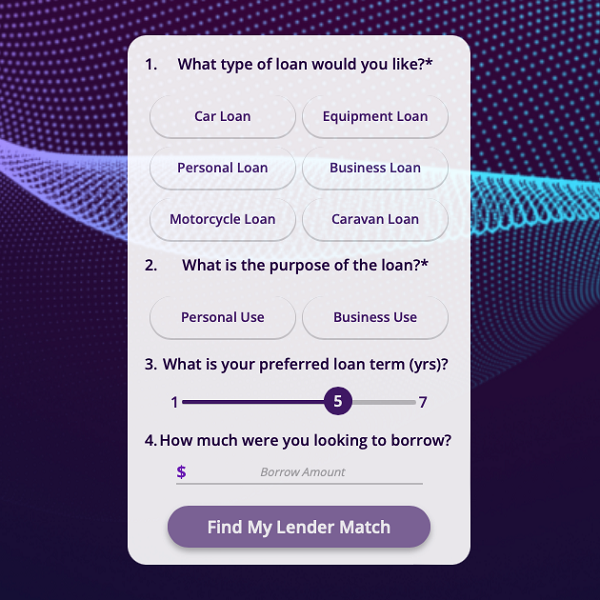

Loans can be applied for online on a tablet, mobile or computer. A combination of loan experts and AI will provide customers with the lenders that will approve them and rank them according to the best offers.

Macquarie Leasing, Commonwealth Bank, Pepper Finance, Plenti, Wisr, First Mac, AutoPay, Latitude, ANZ Bank, Shift, Lumi, Grow, Judo Bank, Prospa, Moula, BOQ, Metro Finance, Westpac, Capital Finance, Liberty, Resimac, Angle Finance, Quest Finance, Money Place, Society One, Finance 1, Money 3, AMMF, are just some of the 60 finance partners that partner with LoanOptions.ai.

Loans cover assets such as cars, motorcycles, caravans, equipment loans, personal loans and business loans. Terms can be from 1 year through to 7 years based on eligibility.

Explainer Video: https://www.youtube.com/watch?v=jWGkW9yZjtM