RBA: Once more, with feeling. By Corpay

Written by Peter Dragicevich, Corpay Cross-Border Solution’s currency strategist, APAC.

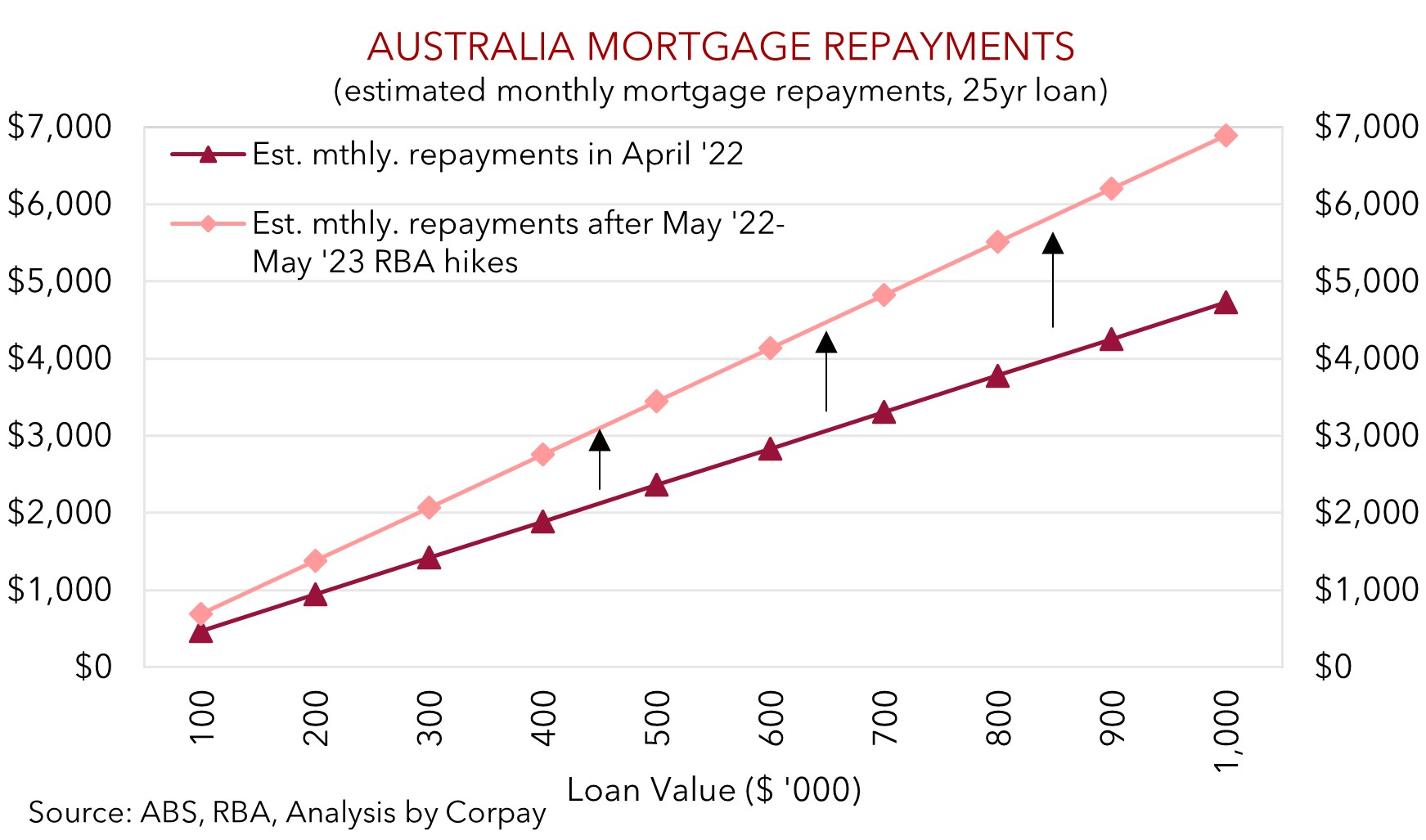

In a surprise to most analysts and markets the RBA raised the cash rate by another 25bps at the May meeting, taking it up to 3.85%. The move means that 375bps worth of rate hikes have now been delivered, making this the most aggressive tightening cycle in several decades.

According to the RBA, inflation has “passed its peak” but at 7% it is “still too high and it will be some time yet before it is back in the target band”. And the “importance” of getting inflation down in a “reasonable timeframe” underpinned the May move. The RBA is still only forecasting inflation to be back at ~3%, the top of its target band, in mid-2025. As such, the RBA has retained a conditional hiking bias, noting that “some further tightening” of policy “may be required” to ensure inflation returns to target; however, it continues to stress that any future moves will “depend on how the economy and inflation evolve.” In our view, while the RBA is still talking tough and has left the door ajar, we doubt further hikes will be needed from here. The jump up in mortgage rates is a substantial hit to indebted households, which is compounding other cost of living pressures. We expect a material slowdown in consumer spending to unfold, and this should flow through negatively to the labour market and inflation.