MONEYME builds on momentum, delivers strong returns

MONEYME Limited has announced its third quarter results for the period ending 31st March 2023.

Strong revenue flows and solid profit growth

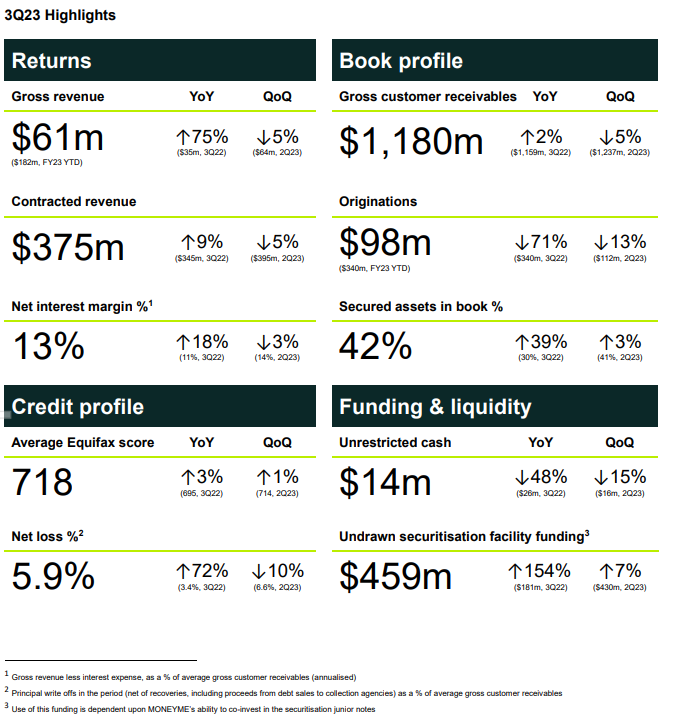

MONEYME delivered $61m in gross revenue for 3Q23 (up 75% on pcp) and is ahead of its target of >$220m for FY23. MONEYME’s ongoing focus on margin protection resulted in a net interest margin of 13% in the quarter (up 18% on pcp).

Building on the strong profit result of $9m in 1H23, MONEYME recorded >$7m in statutory net profit after tax (NPAT) for 3Q23, with another profitable month in March, adding to the January and February profit results previously announced.

The credit profile of MONEYME’s loan book continues to improve in line with MONEYME’s ongoing focus on credit risk management and targeting of higher credit quality borrowers, ending the quarter with an average book Equifax score of 718.

Net losses have reduced in 3Q23 from the prior quarter in line with management’s expectations, as the significantly higher credit quality of the book starts to take effect positively.

Funding and liquidity

MONEYME secured a fully underwritten $37m placement, which is subject to shareholder approval at the Extraordinary General Meeting scheduled for 17 May 2023. The placement will support the planned $32m paydown of the short-term component of MONEYME’s corporate debt facility and balance sheet growth, which will support increased profits in FY24.

Unrestricted cash at $14m is broadly aligned with the cash position in the prior quarter. MONEYME’s cash position is expected to increase in FY24, as cash optimisation strategies take effect, which include the significant interest cost savings that will be achieved from lowering the corporate debt.

MONEYME is on track with its warehouse program to complete a term securitisation transaction for SocietyOne loans in 4Q23.

Innovation and technology update

In January, MONEYME launched its app-based credit score product after a successful trial period. As of 31 March 2023, the MONEYME Credit Score product had attracted ~60,000 customers.

At the end of the quarter, MONEYME began migrating SocietyOne Credit Score customers to the MONEYME app, which is expected to increase customer engagement and cross-sell opportunities.

During the quarter, MONEYME also launched further automation of Autopay for brokers, while the pilot of the Autoscan feature is showing positive results and was expanded to additional dealerships.

ESG and B Corp Certification update

MONEYME launched its Reflect Reconciliation Action Plan in 3Q23, which has been endorsed by Reconciliation Australia, establishing MONEYME’s role in reconciliation and improving its engagement with Aboriginal and Torres Strait Islander peoples and communities. In addition, MONEYME completed its inaugural Gender Pay Gap analysis and achieved 100% renewable energy in its Sydney HQ, as part of its commitment to sustainable practices.

The formal verification process of MONEYME’s B Corp Certification application continued in 3Q23 and is expected to complete before the end of calendar year 2023.

Clayton Howes, MONEYME’s Managing Director and CEO said, “The $37m equity placement announced on 30 March was an important achievement for the business and a testament to investors’ strong confidence in our business model, despite the tight capital markets. The funds raised in the placement will allow us to reset our funding and liquidity position and strategically position the business for profit and sustainable growth.”

“I am pleased to announce that MONEYME’s financial performance remains strong in the third quarter, with strong revenue flows and solid profit growth to build on the momentum from the first half. We have protected our margins through targeted pricing and cost management and continued to elevate the credit profile of our loan book for safer risk management whilst the macroeconomic uncertainty exists. It is pleasing to see net losses on a downward trajectory.”

“In addition, we remain committed to prioritising environmental, social and governance best practice standards. I’m proud of our recent achievements in recognising Aboriginal and Torres Strait Islander peoples and communities, gender pay analysis and reaching 100% renewable energy for our Sydney Head Office.”