Raiz Invest announce quarterly revenue in excess of $5.6 million

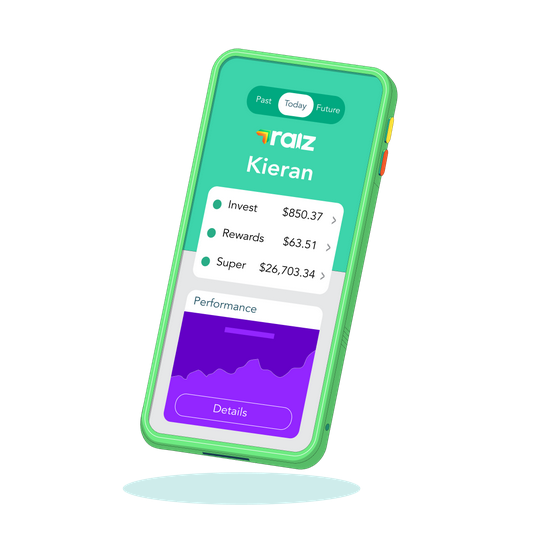

ASX-listed micro-investing fintech Raiz Invest have announced its Q1 FY25 results, with quarterly revenue coming in at $5.66 million, up 15.2% year-on-year (YOY) (+2.6% QOQ), driven by a 4.9% increase in Active Customers YOY.

Customers and portfolios in all segments increased in Q1 FY25 as shown below. Kids Portfolios are not counted as Active Customers until they turn 18, so this growing pipeline represents a future pipeline of Active Customers.

Raiz continues to execute its marketing strategy and has established a number of new distribution partnerships to expand brand awareness, re-engage existing customers and attract new customers.

The addition of 3,824 new Active Customers in Q1 FY25 reflects an acceleration of new customer acquisition, compared to average quarterly additions of 2,708 in FY24 and 1,611 in FY23. Total Active Customers increased to 314,127 at 25 October 2024.

Funds Under Management increased across all products in Q1 FY25 as shown below, with Total FUM increasing 8.3% QOQ and 31.8% YOY.

Brendan Malone, Raiz Invest Managing Director and CEO said, “I am very pleased to deliver another strong quarter for Raiz with solid top line growth, positive operating cash flow and a strengthened balance sheet. From an operational perspective, this has been another very productive quarter, with the expansion of our Plus offering into Super, the launch of automated Raiz Rewards, the establishment of various new partnerships as well as the successful completion of a placement and SPP.

“Our marketing strategy is beginning to show positive momentum, accelerating growth in new customer acquisition, strong growth in users for Raiz Plus, Raiz Super and Raiz Kids and FUM of over $1.5b. Our operations are scalable with a low marginal cost of trading. Raiz is well funded to execute on our growth strategy, we remain focused to accelerate a strong upward trajectory.”