Pearler clocks $500 million invested in CHESS-sponsored holdings, as investors stay the course

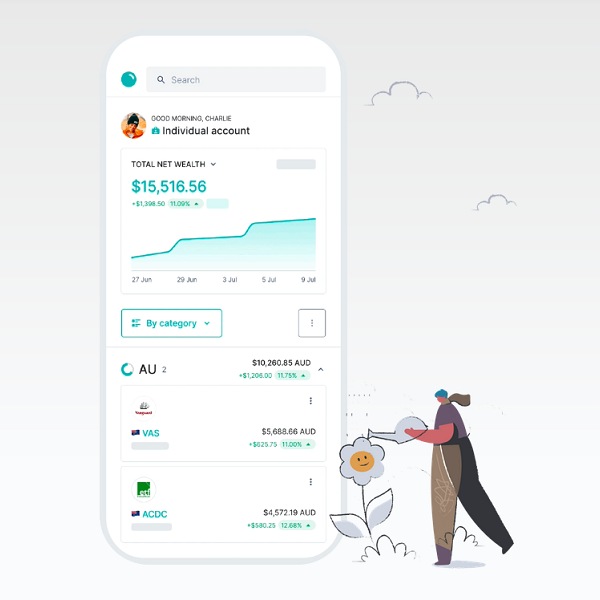

Pearler, Australia’s leading long-term investing and wealth management platform, has surpassed more than $500 million invested in CHESS-sponsored holdings in just its second year of operation.

Despite this year’s market volatility, Pearler’s CHESS-sponsored holdings have more than doubled in 2022.

Moreover, 90% of Pearler investor transactions have been buys, whilst adoption of its Automate product, which allows investors to set and forget their direct share investing has grown to 47% of all trades.

Nick Nicolaides, Co-Founder and CEO of Pearler, said investment trends across the Pearler platform provide an important insight into the financial outlook of younger investors. Gen Y and Gen Z make up the bulk of Pearler’s customer base, 60% and 23% respectively while Gen X comprises 15%.

“The investment behaviour we have observed is counter to what is typically assumed about younger investors – that they embrace riskier options like crypto, meme stocks, and trading gamification.

“What we observe is that younger generations are more financially literate and risk averse than they’re often given credit for, given younger investors are proportionally overweight in ETFs, relative to the market.”

Across Pearler, around 70% of investor holdings are in ETFs, compared with around 2.5% of total ASX holdings.

Within that, the asset allocation is 42% Aussie, and 55% global exposure.

Close to a third, 29%, of portfolios include an ESG-themed ETF.

Whilst, crypto ETFs represent only 1% of asset allocations.

Nicolaides said, “We are not surprised by these numbers. Our investors have shown that they are taking a disciplined approach to getting rich slow, which is an approach we strongly support. When we survey our community, they tell us their intended holding period is nine or more years.”

51% of account holders at Pearler are women.

“What stands out, also, is that women are investing in ESG ETFs at a rate greater than double that of their male counterparts,” noted Nicolaides.

Nicolaides says Pearler investors have also shown they want to be educated through their embrace of Pearler Exchange. Launched in August, Pearler Exchange is a social wealth space where investors can ask questions, test their ideas, and share experiences in a professionally moderated environment.

“Pearler Exchange is a forum where financial experts like planners and fund managers can share deeper thoughts about saving and investing. We’re big on community, long term investment, and financial literacy, and since the inception of Pearler, we’ve seen the difference a supportive community can make in everyone’s investment journey.

“What attracts investors is our emphasis on helping young people navigate their wealth journey over the next 20, 30 or 40 years while giving them the tools to negotiate any market environment,” Nicolaides said.