Australian fintech innovator Lakeba Group partners with the UAE’s AstroLabs

Lakeba Group and AstroLabs have joined forces to usher in a new era of AI and technology innovation in the region.

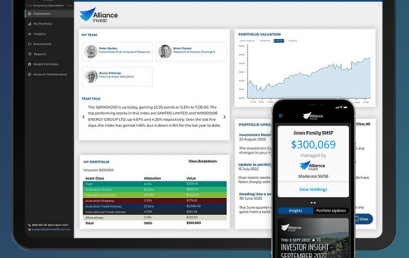

Symmetry Group collaborates with OpenInvest to launch digital investing solution Alliance Invest

Financial advisory firm Symmetry Group have broadened its reach with the launch today of its digital investing solution, Alliance Invest.

Navag8 launches first Australian white label with the Credit Repair Group

Navag8 have launched the first Australian white label of their microsavings app with Credit Repair Group (CRA) in Sydney.

Carrington Labs signs US specialty lender Doc2Doc as a new client

Carrington Labs have announced that it has been engaged to provide credit risk-modeling services to Doc2Doc Lending.

Carrington Labs announces expansion into US banking market with the signing of Utah-based CCBank

Carrington Labs has expanded into the US banking market to provide credit‑risk‑modeling and cash‑flow‑underwriting services to CCBank.

Novigi acquires Iress’ Superannuation Consulting and Managed Services business from Apex Group

Novigi has announced its acquisition of Iress’ Superannuation Consulting and Managed Services business from Apex Group.

Vero Business Pack now available through BizCover

Online business insurance service BizCover have announced a brand-new product offering for its customers: the Business Pack by Vero.

Beforepay delivers record Q3 profitability with continued progress of Carrington Labs

Beforepay achieved a quarterly net profit before tax of $1.1 million, more than triple the Q3 FY24 figure. EBITDA was a record $2.7 million.