Ripple signs up three cross-border payment services

Three companies that provide cross-border payment services plan to use technology developed by startup Ripple that employs cryptocurrency XRP to speed transactions. Ripple, a large holder and promoter of XRP, said its platform for cross border payments, called xRapid, is now commercially available and that it had signed up firms Cuallix, MercuryFX and Catalyst Corporate Federal Credit Union as clients. XRapid uses XRP, a virtual currency powered by distributed database technology called blockchain, to make international payments faster, according to Ripple. Mercury FX and Cuallix are money transfer companies, while Catalyst is a wholesale cooperative financial institution that provides a range of services to 1,400 credit unions throughout the United […]

CSIRO and the University of Sydney’s Red Belly Blockchain breaks new ground for speed

The University of Sydney and CSIRO’s Data61 say they have successfully created a blockchain that can process a mass amount of transactions significantly more quickly than public blockchains, such as the one behind bitcoin. New trials of the Red Belly Blockchain run on Amazon Web Services infrastructure have shown an average transaction delay of only three seconds and a throughput of 30,000 transactions per second. In comparison, bitcoin processes only three to seven transactions per second and as of August had an average confirmation time for a transaction of 10-30 minutes (during peak trading periods in January this has reached as high as almost 3000 minutes per transaction), according to […]

Step-by-Step Guide: How to Create Your Own Cryptocurrency

Introduction Did you know, there are different forms of money? Not just real and counterfeit. Those categories were relevant in the 20th century. Now we have Cash money, digital money or money that can be accessed through online mediums, and plastic money which refers credit cards and debit cards. But in the last decade, the whole world has seen the emergence of a new form of money. It is definitely the cryptocurrency. Cryptocurrencies or virtual currencies are digital assets which can be used as a medium for exchange. Some notable instances of cryptocurrency are Bitcoin, Dogecoin, and Dentacoin. There are many more such cryptocurrencies available online. It is important to […]

What’s the difference between a private and public blockchain?

Blockchain has potential applications in many industries, from accounting to agriculture. It’s essentially a distributed ledger, which records transactions between every user in the chain. There are different types of blockchain: some are open and public and some are private and only accessible to people who are given permission to use them. A public blockchain is an open network. Anyone can download the protocol and read, write or participate in the network. A public blockchain is distributed and decentralised. Transactions are recorded as blocks and linked together to form a chain. Each new block must be timestamped and validated by all the computers connected to the network, known as nodes, […]

Peppermint signs agreement with Philippines’ electronic payment service provider, ECPay

ASX-listed Peppermint Innovation Limited announced it had signed a Memorandum of Agreement with Electronic Commerce Payments, Inc. (“ECPay”), a leading electronic payment service provider in the Philippines. Under the agreement, customers can use Peppermint’s Bizmoto website (www.bizmoto.com.au) to directly pay a variety of bills for their family and friends living in the Philippines, such as power and water, mobile phones and the internet. They can also directly top-up credit cards and debit cards for their family and friends, as well as paying insurance premiums or loan and finance repayments. The direct payment of bills and purchase of e-Loads is viewed favourably by some payees who are reluctant to transfer cash […]

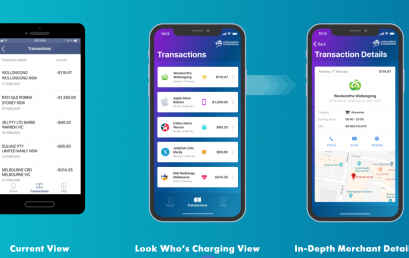

Local FinTech Look Who’s Charging eyes offshore expansion

Local FinTech start-up Look Who’s Charging has been selected as one of only 24 companies from around the globe to present their business on the centre stage at Money 2020 in Las Vegas this coming October. Look Who’s Charging is a Data as a Service business and one of the first companies globally to solve the problem of unrecognisable transactions. Look Who’s Charging links the often-random narratives from debit and credit card transactions to in-depth merchant details. NAB integrated Look Who’s Charging into their digital applications earlier this year. In the past 12 months Look Who’s Charging has helped to de-mystify over 15 million transactions many of which would have […]

Australian startups selected for Accenture’s FinTech Innovation Lab

Eight leading fintech companies have been selected for the fifth annual FinTech Innovation Lab Asia-Pacific, a 12-week mentorship program created by Accenture. The 2018 program received a record number of applications, from more than 160 companies, and comes at a time when investments into the sector are soaring. According to an Accenture analysis of data from CB Insights, global investment in fintech ventures reached another all-time high in 2017, of US$27 billion, with continued growth in 2018. Launched in Hong Kong in June 2014, the FinTech Innovation Lab Asia-Pacific has received nearly 600 applications since its inception, with 33 companies participating to date. Alumni companies from the Lab have raised US$288 […]

How Fintech is making Insurance more affordable

Fintech is one of the most rapidly growing fields at the moment, not just in the technological sector but as a whole. And it makes a lot of sense when one considers the numerous implications it has in our everyday lives, especially when it comes to large-scale institutions’ operations and the way they are able to meet the demands of large numbers of people. Insurance companies are seeing some strong benefits from the growth of fintech and their connection to that industry, and it’s interesting to think about the future possibilities for the cheap insurance sector. Better Customer Segmentation Companies now have access to much more data about their customers, […]