APP-Y NEW YEAR – Mozo’s top four fintech tips to help keep your financial resolutions on track

Sticking to financial resolutions can be tricky but there’s fintech apps that can help unlock possible savings and track your expenses.

6th Annual FinTech Awards 2021 – Winners announced!

Now in it’s sixth year, the FinTech Awards celebrates the entrepreneurs and Australian fintechs who are doing amazing things.

6th Annual FinTech Awards 2021 – Finalists announced

The 6th Annual FinTech Awards 2021 are almost here, and ready to recognize the great entrepreneurial spirit of Australian fintech businesses!

Australian fintechs feature strongly in the 2021 AFR Fast 100 and Fast Starters lists

The Australian Financial Review have released their annual Fast 100 and Fast Starters lists for the fastest growing companies in Australia.

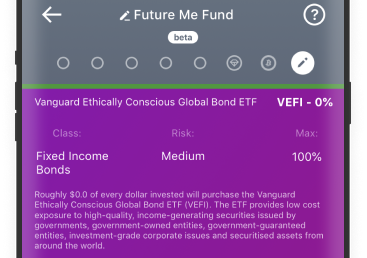

Investing with Confidence: More young Aussies customising their ETF asset allocation

Raiz allows lets investors to build their own personalised portfolio asset allocations by choosing target weightings from a selection of ETFs and Bitcoin.

Envestnet | Yodlee continues its commitment to Australia’s FinTech sector by becoming the Leading Sponsor of Australian FinTech

Envestnet | Yodlee has today announced it has become the official leading sponsor of Australian FinTech and its global channels.

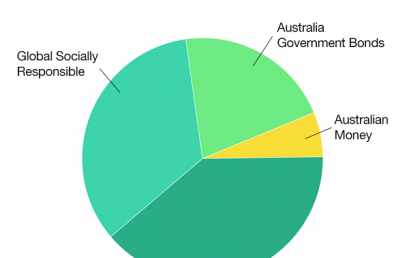

Socially responsible investing continues to attract younger Australians

According to Raiz, the growth in the Emerald portfolio illustrates the growing demand for socially responsible investing in Australia.

Moneythor & Envestnet | Yodlee partner to leverage Open Banking for personalisation in Digital Banking

Moneythor and Envestnet | Yodlee announce a partnership to leverage open banking for personalisation in digital banking Australia and New Zealand.