Opportunity shifts to the private markets as listed markets continue to remain volatile: PrimaryMarkets

Investors looking for opportunities in equities shifted their focus from the public to the private company market in the September quarter.

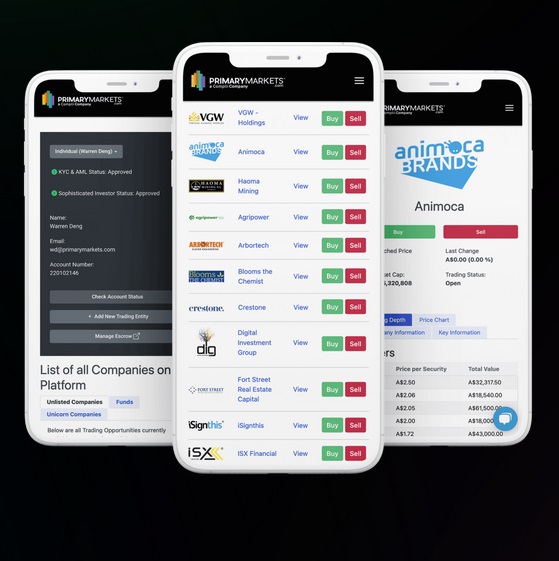

PrimaryMarkets, Australia’s largest trading platform for privately listed companies, reports that trading activity was strong in the quarter, with over $100 million traded.

According to PrimaryMarkets recent report, investors in public equity markets are wary, after seeing local and international markets continue to deteriorate. The S&P/ASX 200 Total Return Index fell 11.6% in the six months to September 2022, including a 6.2% fall in September. The MSCI World ex-Australia Index fell 8.1% over the six months, including a fall of 3.2 % in September.

Marcus Ritchie CEO of Primary Markets, says a key difference between public and private markets is that private companies tend to command a lower trading multiple.

“The benefit for investors is that private companies offer better value. Investors are responding to that now, especially as they seek alternative opportunities,” Ritchie said.

Companies that list on the PrimaryMarkets Platform have strong growth prospects and many of the companies on the Platform are continuing to post strong results.

Sectors that traded well during the quarter included technology and gaming stocks, and renewables such as Hydrogen. In the tech sector investors are interested in companies involved in tokenised platforms, the Metaverse and Web 3.0 initiatives.

One of the companies trading on the PrimaryMarkets Platform, Virtual Gaming World, reported revenue and earnings growth in excess of 50% in the 2021/22 financial year and an operating profit of more than $550 million.

Other activity on the Platform during the September quarter included a 9% increase in international listings, led by cannabis stocks, and a 27% increase in financial technology listings.

Financial technology companies on the platform include Automation Anywhere, BlockFi, Netskope, Ripple, Klarna, Tanium, ThoughtSpot, Upgrade and local neobank Alex Bank and payments services company Mint Payments.

Ritchie said, “In public markets, raising capital is extremely hard at the moment, given the economic circumstances. If you look at the ASX IPO pipeline, there is a significant drop-off now, compared with the same time last year

“However, capital raising opportunities on our Platform rose 16% during the quarter, in a difficult environment.”

Additionally, PrimaryMarkets added three new unicorn listings – analytics and AI company ThoughtSpot, data analytics specialist Starburst Data and data security company Tanium.