One year in and Open Banking provider Frollo has 12 live Data Holders

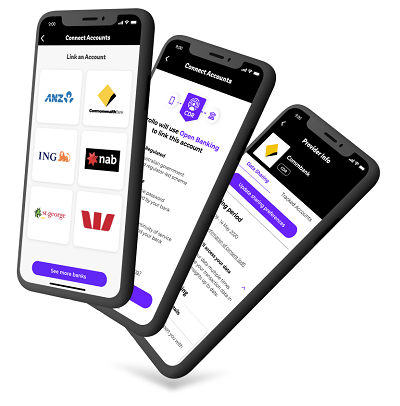

On 1 July 2021, one year after the Consumer Data Right kicked off in Australia, Open Banking provider Frollo announces it has launched Data Holder number 12 on their Open Banking platform – taking them from ‘Active’ to ‘Live’.

In addition to the Big Four banks and Regional Australia Bank – who all launched last year – a number of tier two & three banks, mutuals and neo banks are now available via Open Banking, bringing coverage up to approximately 90%.

When a Data Holder goes live

When Data Holders get the ‘Active’ status on the CDR registry, they become available for Data Recipients to test and enable on their platforms (if all testing goes well). Once a Data Holder is enabled on a platform like Frollo’s, they’re live.

The Frollo Open Banking platform powers the Frollo consumer app and CDR Gateway, enabling business clients to collect and use Open Banking data. Once a Data Holder is live on the platform, they’re instantly available to Frollo app users and clients using the CDR Gateway.

The list of Data Holders that’s currently live looks as follows:

- AMP

- ANZ

- Australian Military Bank

- CBA

- Judo Bank

- NAB

- Regional Australia Bank

- RSL Money

- Tyro

- UBank

- Up Bank

- Westpac

Other Data Holders that are currently active on the registry include Suncorp, Macquarie Bank, Volt Bank and Citi, Coles financial services and Qantas Money. More are expected to become ‘Active’ and ‘Live’ over the next few days and weeks.

Live Data Recipients

Like the number of Data Holders, the number of Data Recipients is also growing. Currently there are 12 Data Recipients accredited to receive Open Banking data.

The big difference is that there are only two Data Recipients actually live in the market: Frollo and Regional Australia Bank. Both have been live since 1 July 2020, when Open Banking launched in Australia.

With over 10 Million Open Banking API calls, Frollo is responsible for more than 95% of all Data Recipient activity to date.

Other Accredited Data Recipients like CBA and Finder haven’t launched their use cases yet, but will hopefully do so in the near future.

Because guess what? Australians can’t wait!