Nucleus Wealth navigates troubled waters to stay ahead of the pack

The wealth and superannuation manager, Nucleus Wealth, has enjoyed a stellar 12 months to 30 June, 2020 with five of its six funds in positive territory, as revealed in the latest Morningstar data to 30 June, 2020.

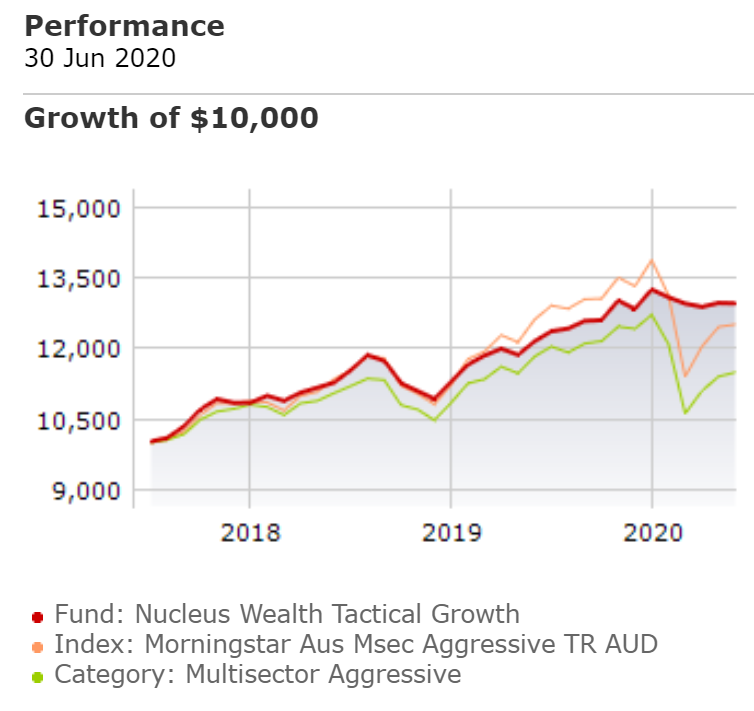

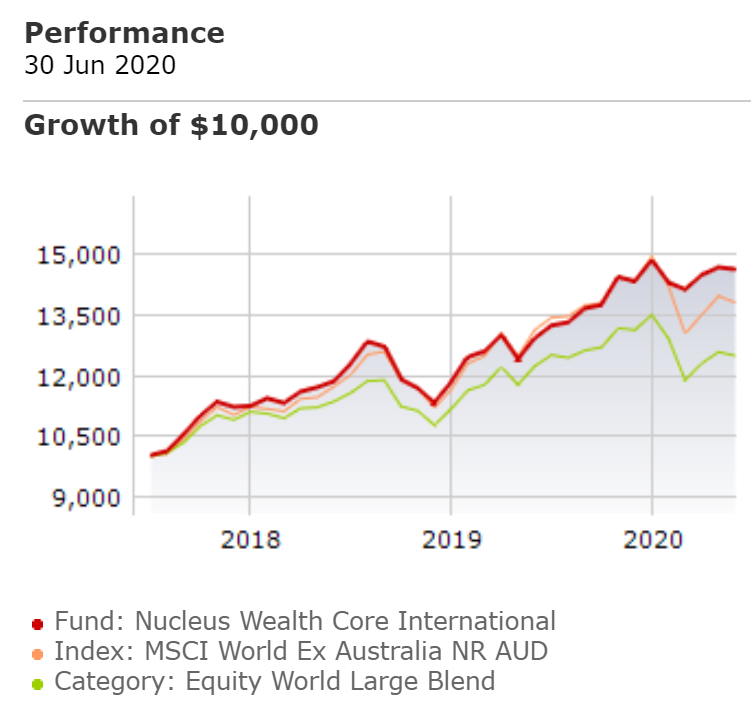

In what has been the most volatile trading period since the Global Financial Crisis (GFC), the performance of two of Nucleus Wealth’s growth funds, Tactical Growth and Core International, compares extremely favourably with its peers, with the former ranking first in its index category and the later fifth.

These performance rankings are magnified by the fact there are 173 funds in the Tactical Growth index category and 209 in the Core International index category.

The other three funds to outperform were the Tactical Income, the Tactical Accumulation and the Tactical Foundation, with these funds ranking first, sixth and sixth, respectively, in their index categories (38, 225, 380).

The only fund to slip backwards was the Core Australia Fund, and even then it finished 15th out of 332 funds in that index category.

Nucleus Wealth’s Head of Investments Damien Klassen said, “It’s been a difficult 12 months, especially since February when the impact of the COVID-19 pandemic started to become apparent.

“Working on the premise that prevention is better than the cure, we acted quickly to de-risk our portfolios before the markets went into a tailspin, thus ensuring our clients were protected from the market carnage that occurred once markets realised the gravity of the pandemic and its inevitable economic fallout.

“We still remain cautious, and although that has meant missing out on some of the subsequent market upswing it has still allowed our portfolios to outperform significantly over the year without our investors experiencing the extreme market volatility of many other fund managers.”

Nucleus Wealth Tactical Growth

Nucleus Wealth Core International

Source: Morningstar