Neobanks lead the way with fast Open Banking APIs: Frollo

Leading Australian Open Banking provider Frollo has released its first Open Banking API performance monitor, comparing end to end response times between Data Holders. Frollo’s data shows that neobanks Up and 86 400 are leading the way with fast APIs, taking less than half the time than most other banks to deliver CDR transaction data.

July 2021 marked a big milestone for the Consumer Data Right in Australia, as data sharing obligations kicked in for many Australian banks. As the number of live Data Holders has increased from 5 to 35, Open Banking coverage is close to reaching 90%. With coverage at this level, Frollo decided to answer the question: How are the APIs that underpin the CDR actually performing?

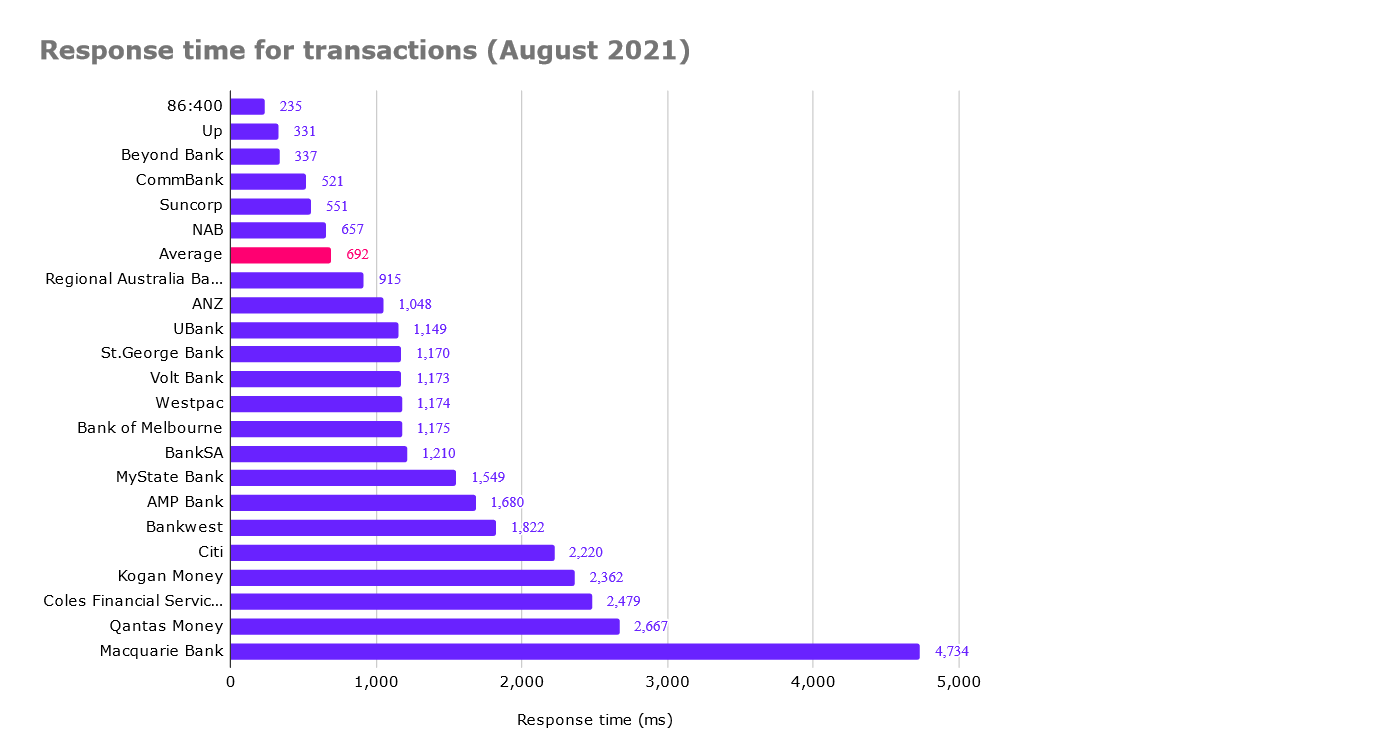

Response time for transactions

86 400 provides transaction data in less than 3oo milliseconds.

Data for August 2021 paints a picture of neobanks leading the charge with fast Open Banking APIs.

The ‘Transactions for account API’ returns all transactions for an account, including date & time, amount and description. 86 400, Up Bank and Beyond Bank all provided transactions in less than 500ms on average. That’s a stark difference when compared with some of the slower banks that took more than 2,000ms to provide this data.

Overall, 7 out of 22 brands returned the data in less than 1,000ms and the average across all brands was just under 700ms.

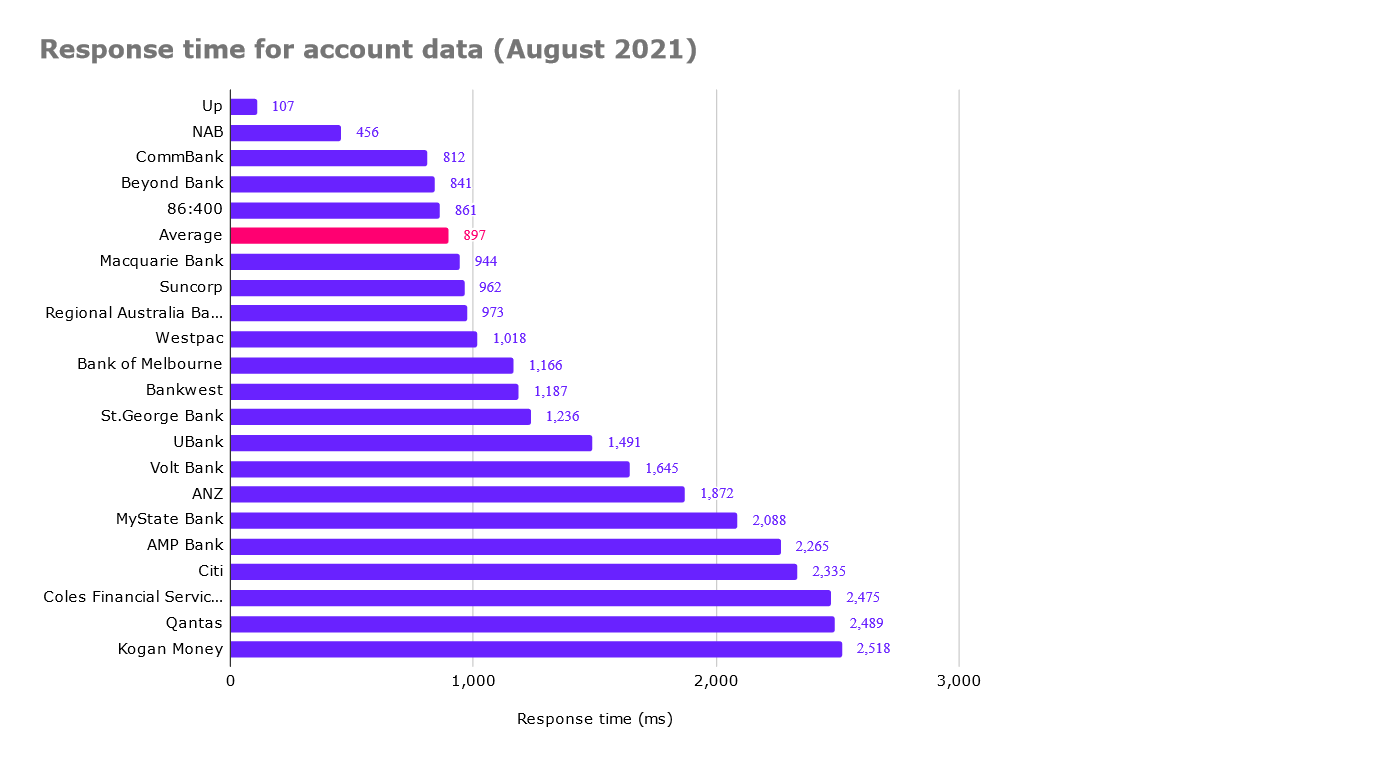

Response time for account data

Up Bank response time for the Accounts API was more than 3x faster than the second fastest bank.

The second API in this comparison is the Accounts API. It provides basic information for a specific account, like the status, product category and whether the account is owned by the authorised customer.

The clear winner was Up Bank – by a margin. With a 107ms response time the neobank nearly achieved a sub 100ms average. Number 2, NAB averaged at 456ms. In total, 8 brands were able to return account information in less than 1,000ms, 6 took more than 2,000ms.

The average across all brands was just under 900ms.

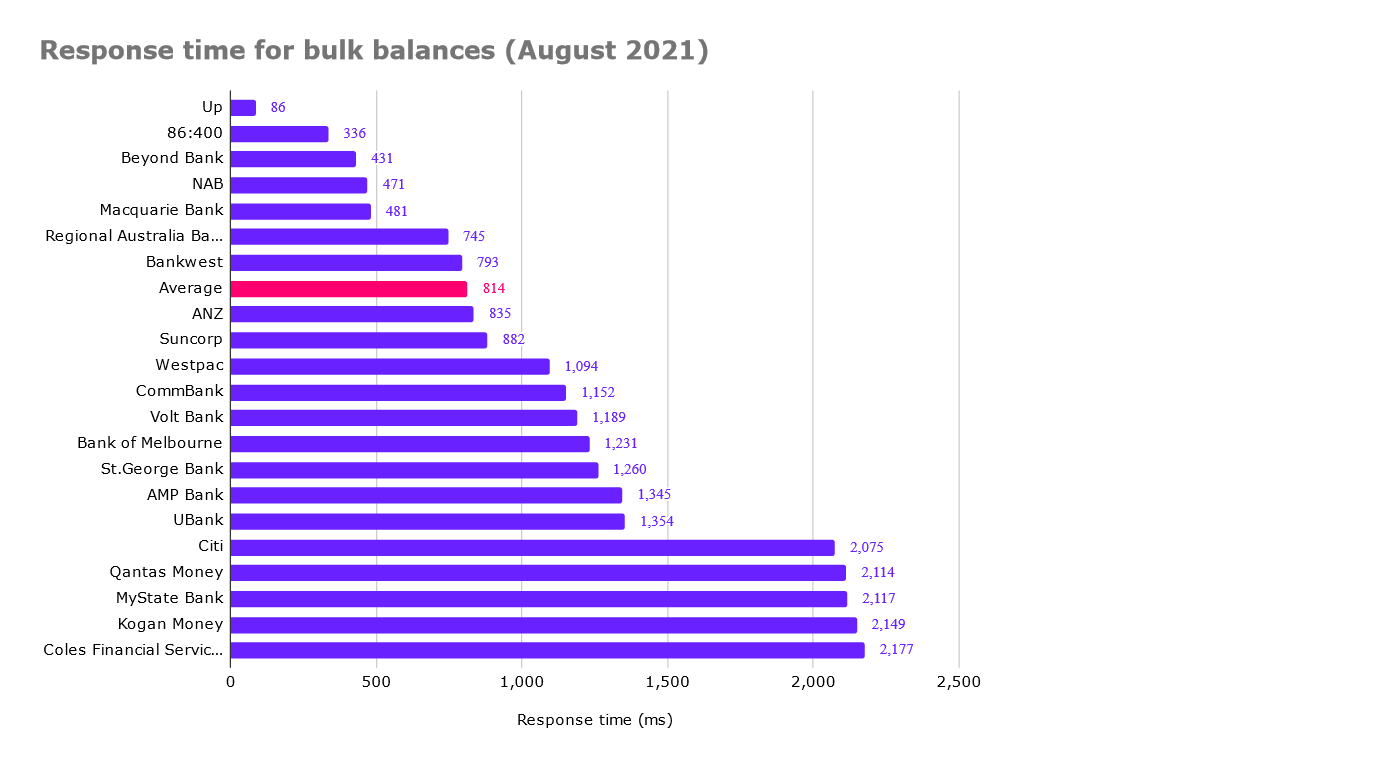

Response time for bulk balances

Up Bank delivers bulk balances in less than 100ms.

The last API Frollo compared is the Bulk Balances API. It provides balances for multiple, filtered accounts. Here, Up Bank was able to break the 100ms barrier and returned bulk balances in 86ms on average.

Number two 86 400 took just over 300ms and a total of 9 brands came in under 1,000 seconds. 5 brands took more than 2,000ms to provide the balances.

The average across all brands was just over 800ms.

Open Banking API monitoring report

The Frollo Open Banking platform has made over 14 Million Open Banking API calls in production to date, across the 36 live Data Holders. This provides Frollo a unique perspective on API performance between the different Data Holders.

Find out more about how Open Banking APIs are performing: www.frollo.com.au/open-banking/open-banking-api-performance/