ME Bank launches Google Pay as demand for digital payments increases

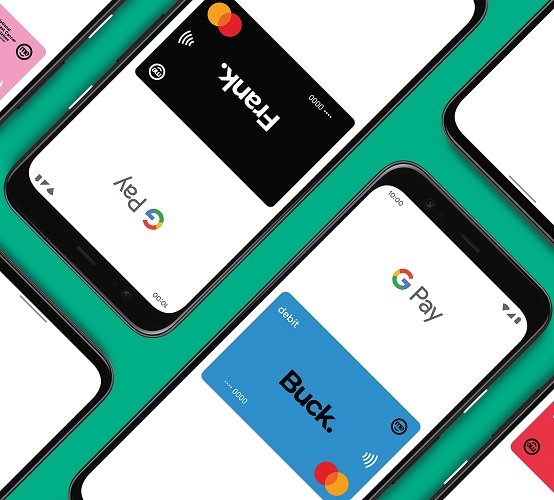

ME Bank has introduced Google Pay today as its customers increasingly switch to contactless and digital payments.

From today, ME customers have a new cashless payment option with the launch of Google Pay, the globally trusted payment app for Android smartphones. ME customers will now be able to connect their ME debit and credit cards to Google Pay for use in-store, online and via apps, both in Australia and for overseas online shopping.

ME Group Executive Customer Banking, Craig Ralston said: “Our customers are using cash less and contactless and digital payments more, so it makes sense for ME to increase the number of ways our customers can pay digitally with the addition of Google Pay.”

ATM withdrawals by ME customers have almost halved since the start of the COVID-19 pandemic. Total ATM withdrawals in the last six months (March-Aug 2020) declined 45% compared to the six months prior (Sep 2019-Feb 2020), ME payment data reveals. The total dollar amount withdrawn from ATMs by ME customers also fell 31% over the same period.

“COVID-19 is accelerating the trend away from cash towards cards and digital payments. ME customers using an Android device will now be able to use Google Pay to pay for things without touching PIN pads or handling cash,” Mr Ralston added.

Google Pay protects payment information with multiple layers of security, using one of the world’s most advanced infrastructures to help keep ME customer information safe.

Digital payments are simple to use for Australians of all ages. A 70-year-old ME customer recently told the bank her digital wallet is “very easy” and “the way of the future”.

Android users can use Google Pay if they have a ME Bank debit or credit card and their smartphone is running Android Lollipop 5.0 or higher.