Lifepay taps into Novatti’s ecosystem to launch new B2C fintech platform

Leading digital banking and payments company Novatti announces the launch of Lifepay, a new, innovative fintech platform that leverages Novatti’s technology and licences, while further extending Novatti’s B2C reach.

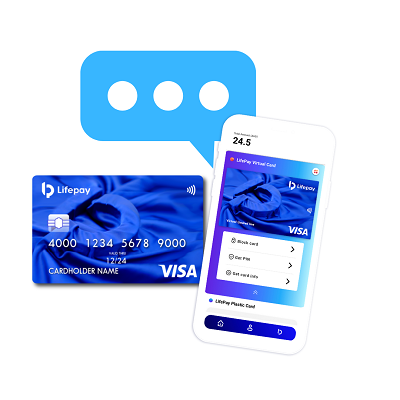

Lifepay’s integrated financial platform enables users to manage their daily life transactions, personal and social finances simply and effectively from their mobile device. In doing so, it provides consumers with access to the latest technology in banking and payments.

Lifepay’s services include:

- Digital banking – with transactional bank accounts, access to Visa Prepaid cards, real-time fund transfers

- Payments – providing access to multiple payment methods, such as QR codes, Tap and Go and P2P transfer, as well as bill payments (such as BPAY) through card or mobile

- Socialising – connecting friends and family financially without the need for bank details, enabling easy funds transfers

Lifepay is currently conducting a soft launch for up to 200 consumers, with a full commercial launch planned for early March 2021. Lifepay’s services are expected to then be extended to include international transfers and connectivity to investment and lending platforms over the following six months.

Novatti is a major shareholder in Lifepay Pty Ltd, holding 25% of its shares prior to the Series A funding. Lifepay has now secured a Series A investment of up to $2.5m at a pre-money valuation of $20.5m, implying a valuation of $5.125m for Novatti’s shareholding. This investment is being progressively drawn down against the business plan and, if fully drawn down, Novatti’s shareholding will reduce to approximately 22%.

In addition to benefiting as a shareholder from future growth in the platform, Novatti will also earn fees from activity on the Lifepay platform, including compliance services, cross border payments, payment acquiring, and the issuing of Visa Prepaid cards, depending on take up of the service. Lifepay will also act as a channel partner for other Novatti products and services and as a potential customer acquisition channel for Novatti’s banking business, with its application for a restricted banking licence currently being assessed by the Australian Prudential Regulation Authority (APRA).1

Novatti’s Managing Director, Peter Cook, said, “Novatti’s strategy has been to develop a digital banking and payments ecosystem that enables innovative products to leverage Novatti’s existing platforms to get to market quickly. This strategy also enables Novatti’s platform to scale quickly, providing customer acquisition and value-add channels for our existing businesses, extending our reach into the B2C market, while generating high-margin revenues.

1. Novatti ASX Announcement – Update on APRA banking licence issuing – 11 August 2020