LENSELL launches a new version of Diversiview

Australian FinTech member LENSELL is delighted to announce a new version of their flagship application, Diversiview®.

Retail investors can now access several new features – unique on the market, to help make better-informed investment decisions with confidence.

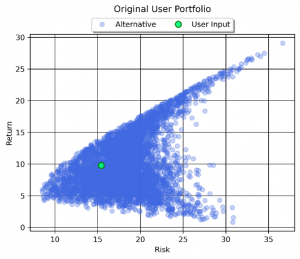

Portfolio Positioning

Know the risk and return of your portfolio position and see where it sits in relation to many other possible portfolio positions for the same set of securities.

Are you happy with that portfolio position?

→ If yes, congratulations!

→ If not, ask yourself where do you want your portfolio to be: do you want a lower risk, a higher return, or both?

You can try different scenarios (with different sets of securities, or with different weights/allocations for the same securities) or you can use the Balancer to take your portfolio to the desired state.

Diversification Rating

How many times you tried to compare two or more portfolios in terms of diversification? Are 7 industry groups always better than 5? Not necessarily.

Diversiview uses the power of granular, deep diversification – that is, the diversification at security level that is fundamental for the Modern Portfolio Theory.

The deep diversification is shown that as a visual, interactive diagram because it’s easier to interpret than just numbers.

The diversification rating penalises the strong positive and the positive correlations between securities because they hinder the diversification the most.

So you can compare and know which portfolio has a better deep diversification.

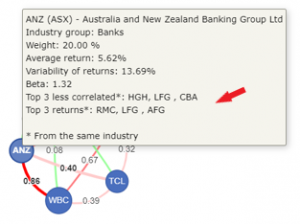

Diversification alternatives

When you consider diversification alternatives to one security, you aim to find other securities, from the same industry, that have good expected returns and that are less correlated than your current choice.

With over 2000 securities listed on ASX, it’s time consuming to find them. Diversiview can now help with that search.

For each security in the analysed portfolio, Diversiview shows the top 3 least correlated securities and the top 3 with highest expected returns – from the same industry.

Note that they may, or may not be, good alternatives for your portfolio and needs – there may be others, more suitable for you.

Remember that this is not financial advice. Diversiview only offers the insights you can use to make better decisions – by yourself or together with your financial planner.

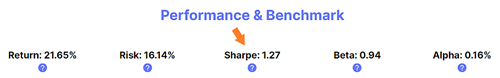

Sharpe Ratio

The Sharpe ratio is a widely used method for calculating the risk-adjusted return. Investors generally look for a Sharpe ratio around or above 1 as it indicates portfolio’s outperformance per unit of the portfolio’s volatility.

You can find it together with other four portfolio level performance indicators.

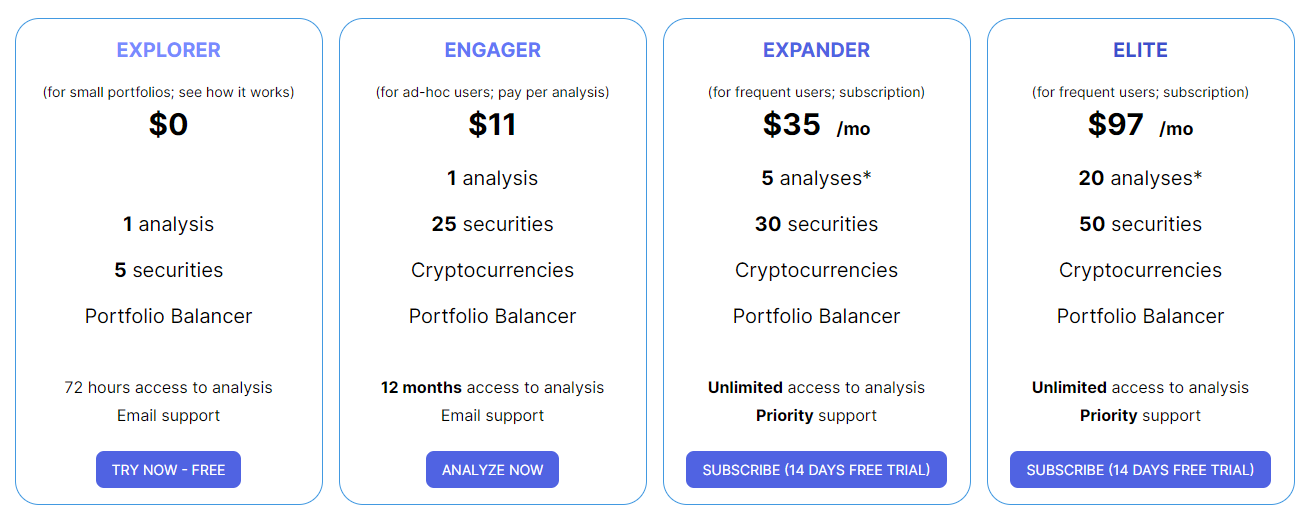

New plans

Diversiview plans have changed so there are more options and it’s even more affordable to run portfolio analyses.

Whether you plan a new portfolio and need to try and compare several scenarios, or you just validate your portfolio’s position from time to time, you’ll find an option that works for you.

For people who need to run even more analyses, contact the team.

Give it a try today: www.diversiview.online

Australian FinTech members continue to receive a 20% discount on Diversiview analyses (Engager plan)

– use the code AFT2021 at the checkout –