LENSELL announce new feature in their flagship application Diversiview

One of the most requested features from Diversiview users – Analyse with Preferred Returns!

Diversiview is the #1 AI-based Portfolio Optimisation tool for active investors who want to boost their portfolio performance.

Why preferred returns?

Diversiview calculates the total Expected Portfolio Return as the weighted average of the expected returns of the individual investments within that portfolio.

By default, the individual expected returns are calculated using the historical returns of that investment during the immediate past 3 years.

However, many factors will impact on any investment’s future performance and experienced investors make their own judgements about how that performance will look like.

Those assessments can now be used in Diversiview to analyse the overall portfolio health and performance.

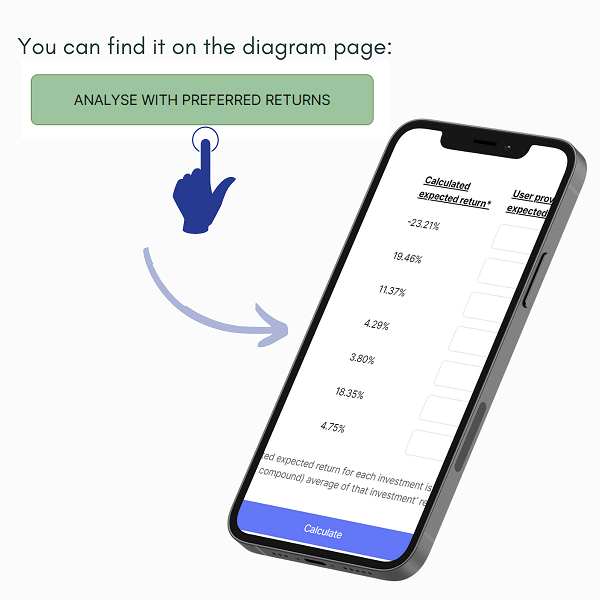

It’s now easy to enter your own predicted return instead of the calculated values. Here’s a quick overview of how you can use it:

Navigate to the bottom of the diagram page and enter your own predicted return for each security instead of the calculated values.

LENSELL continue to listen to their users’ requests, and continue to add amazing and unique features to Diversiview.

Keep an eye on their next announcements and exciting offers coming up soon!

If you have any questions, contact the LENSELL team at: [email protected]