Laboratories Credit Union and Moroku collaborate to revolutionise digital loan applications

In a groundbreaking partnership, Laboratories Credit Union (LCU) and Moroku, a leading fintech company, have continued to transform the digital banking landscape. This latest collaboration streamlines the loan application process, making it faster, more convenient, and accessible to a wider audience. In the highly competitive lending environment, getting decisions to members fast is a key competitive requirement as Generation Now members’ expectations for digital continue to rise.

Digital Loan Applications in Minutes

Members seeking loans often face cumbersome paperwork, lengthy approval times, and the need to physically visit a branch. With this new collaboration, those days are over. Here’s what borrowers can expect:

- Instant Access: Members can now apply for loans from the comfort of their homes, offices, or even on the go. No more waiting in queues or scheduling branch visits.

- Conditional Approval within 3 Minutes: The innovative platform developed by Moroku leverages advanced algorithms and data analytics. Within just three minutes, applicants receive a conditional approval decision based on their creditworthiness and financial history.

- Seamless Integration: The credit union’s existing digital channels seamlessly integrate with Moroku’s platform. Members can initiate loan applications via the credit union’s website or mobile.

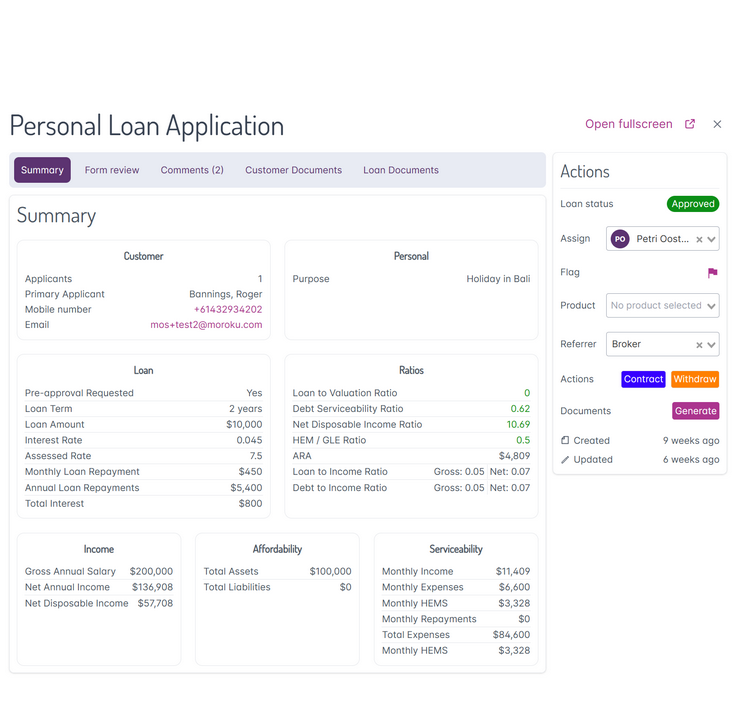

Agile Sales Management Speeds Decisioning

Process optimisation starts with identifying bottlenecks and adopting a constant process of improvement. The key bottleneck in the lending process is getting a decision to the customer. Once this is optimised, through automation and the application of algorithms and analytics, downstream improvements can be sought. Here’s how the new decisioning process provided by Moroku and adopted by LCU, applies agile sales management and data to speed decisioning:

- Pushing decisioning upstream: While members previously forwarded their applications to a decisioning team for answers, algorithms can now be embedded within the application process real time. This cleans up the lending funnel, providing higher quality leads to the lending team, allowing them to focus on deals that have a higher degree of success.

- Agile: Although agile does not yet have the same traction with sales teams as it has with software development, the application of agile protocols across the business brings accountability, cadence and economics, identifying key blockers to deals in the pipeline, to get decisions to members fast.

Industry leading Economics and Implementation Speed

LCU and Moroku signed an agreement to deploy Moroku Lending in December 2023 and commenced the project in January 2024. During the Australian summer, the Moroku and LCU teams go started and deployed the solution, incorporating digital identity verification and loan origination within 9 weeks. Whilst others have been taking multiple years and spending millions, the collaboration has set new cost and time benchmarks on what is possible with complete, cloud first software solutions:

- Speed: Focussing on configuration not customisation dramatically reduces workload. The solution predominantly requires LCU to provide branding, templates and configuration of the risk modules, not writing them.

- Cost: With the reduced workload, the number of consultants and internal staff members required to be involved in the project, a total of 8, not only reduces over time but also means that the staff involved can continue to work on their day jobs more efficiently, with everyone involved in the projects doing so on a part time basis.

Commenting on the partnership, Helen Lorigan, CEO of Laboratories Credit Union, said, “Our mission is to empower our members with financial solutions that enhance their lives. By partnering with Moroku, we’re taking a giant leap toward achieving that goal. Digital loan applications are just the beginning.”

Colin Weir, Co-Founder and CEO of Moroku, added, “We’re thrilled to collaborate with LCU. Our technology bridges the gap between what larger banks can provide with billion-dollar investments versus smaller competitors by leveraging the power of agile development, cloud and culture.”