Global investment management organisation implements GBST’s Tax Analyser

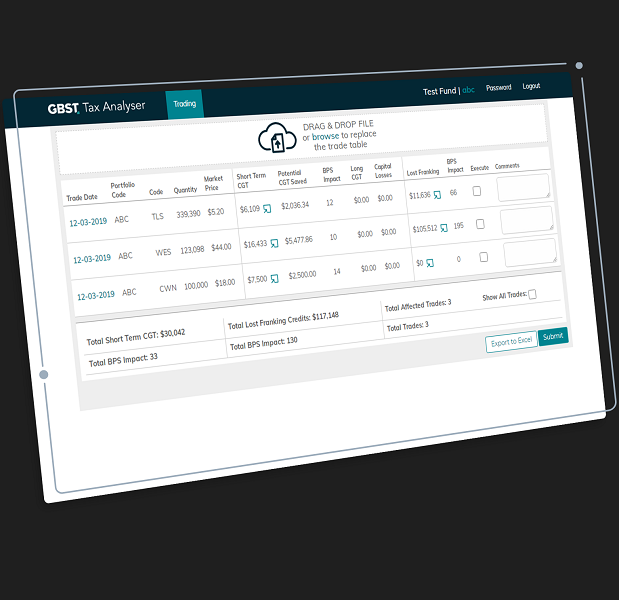

A leading global investment management organisation has implemented GBST’s Pre-Trade Tax Analyser solution in Australia to analyse the tax impact on both Australian and Global Equities.

The firm will use the tool to query proposed Australian Equity trades before trading to better understand the potential capital gains and franking credit tax outcomes. A first in the market, it will also be utilised on the financial institutions own funds that hold investments in foreign listed securities – enabling its investment managers to understand the potential capital gains tax outcomes that may arise on those Global Equity asset disposals.

Robert DeDominicis, CEO at GBST, said, “We are delighted that another market leading institution has chosen Tax Analyser. It is the only stand-alone technology solution in the market today that utilises the latest available custodian tax data and our purpose-built sophisticated calculation engine to allow pre-trade tax aware investing.”

According to Kathy Taylor-Hofmann, Business Solutions Executive for GBST’s tax suite of products, there are substantial uplifts to returns that can be achieved through tax-aware investment management. “CGT is payable on both Australian and Global equity disposals. If you sell a capital asset you’ve held for less than 12 months, there can be tax leakage. If capital assets are disposed of by a superannuation fund after having been held for more than 12 months, then potentially only two thirds of the gain will be taxable, saving 5% in tax – this can be a significant amount.

“Similarly, for investment trusts that hold capital assets for 12 months or more, up to half of the gross gain distributed may not be subject to tax by the recipient investor. Further, by ensuring franking credit entitlements from investments in Australian equities are not lost through the application of the ‘45-day rule’, entities can further improve after tax outcomes.

“Providing visibility to investment managers regarding the tax impact of a proposed trade prior to trading, is the only way managers can ensure these tax benefits are not inadvertently lost, and we are delighted that our patented solution will be used to achieve this outcome.”

The firm chose to implement Tax Analyser to provide additional support to its managers and ensure tax-aware investment management is an integral part of its pre-trade process. Having access to query the most up-to-date custodian tax data through Tax Analyser will enable its managers to review the relevant tax outcomes before they trade, and then determine if they want to proceed with their original trade or take a different course of action which may result in a better after-tax outcome for investors. Given Tax Analyser also provides a record of the managers intended course of action, the solution can be used to confirm tax awareness throughout the investment process.

“When delivering the very best service and optimal after-tax outcome for investors is key – GBST’s Tax Analyser ensures tax outcomes are considered as part of an investment decision process, every time a trade is undertaken,” said Taylor-Hofmann.