Frollo’s AI turns transaction data into insights

Frollo are launching their Data Enrichment API to help their B2B customers turn transaction data into insights. Frollo’s AI-powered data enrichment engine brings together the power of big data and smart algorithms, and packages it up in one easy to use API for anyone to use.

The challenge: Turning raw data into insights

Transaction data holds the key to better lending decisions and it can provide insights so that customers can get ahead, but using it effectively can be challenging:

- Transactional data is raw, unfiltered and unstructured, making it hard to extract value for you and your customers

- Classifying and categorising transactions is complicated, and a basic, rules based approach doesn’t cut it

- Less accurate categorisation can quickly lead to a bad user experience, low quality insights and worse credit decisions

The solution: The Frollo Data Enrichment API

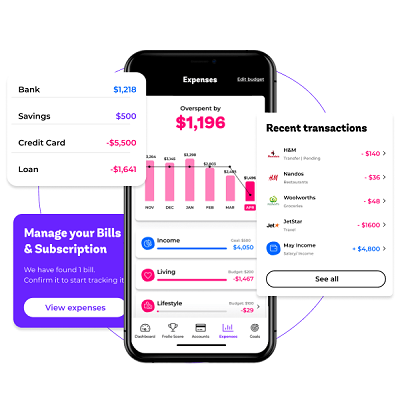

Change the game by turning ambiguous transaction data into clear, contextualised information including merchant classification and categorisation.

Whether you’re using Open Banking data, third party aggregators or direct bank APIs, the Frollo Data Enrichment API helps you extract insights into your customer needs and behaviour, improve the customer journey and drive more meaningful interactions. All in one easy to use API.

Key benefits

- Market leading accuracy – With 95% categorisation accuracy you can confidently build products using Frollo’s insights

- Multi data source solution – Use Open banking data, third party aggregators, direct API’s or all of the above (use Frollo’s aggregation engine or a third party solution)

- One single API – All you need is one API. Send Frollo your transaction data and you’ll have it back within seconds, categorised and enriched

- Continuously learning – Frollo’s AI powered models are always learning and improving based on new data

To learn more, have a look at Frollo’s Data Enrichment API page, or download the product sheet. Are you interested in a demo? Get in touch!