Frollo first app to use Open Banking product information

Frollo, a leader in B2B Open Banking solutions and the first app to launch with CDR for consumers in July 2020, has achieved another Australian first by making CDR product information available to its app users.

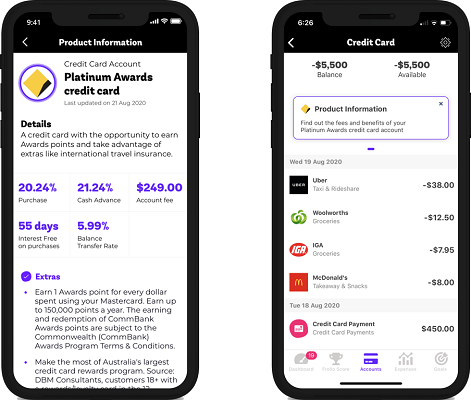

From today, Frollo users will be able to easily check the rates, fees and extra’s of their financial products in the Frollo app. Users who have linked eligible products will automatically get access to accurate, up to date information about these products using Product Reference Data (PRD) APIs.

This is only the first step in using product information for the purpose driven fintech, as it sees many possibilities to use CDR to help its users.

The combination of real time transactional data and accurate, up to date product information is extremely powerful. It allows Frollo to truly understand its users’ finances and help them make better financial decisions, and get a better deal on their finances.

Whether it’s helping them meet the conditions of their bonus interest savings account, nudging them to pay off a little more on their credit card to avoid fees or to find a financial product that better suits their situation, it’s all possible and very exciting.

Product information is currently available for all CDR linked transaction accounts, savings accounts, credit cards and personal loans.

Download the latest version of the Frollo iOS app here to get access to product information.