First-to-market app 1bill set to change the way Aussies manage and pay household bills

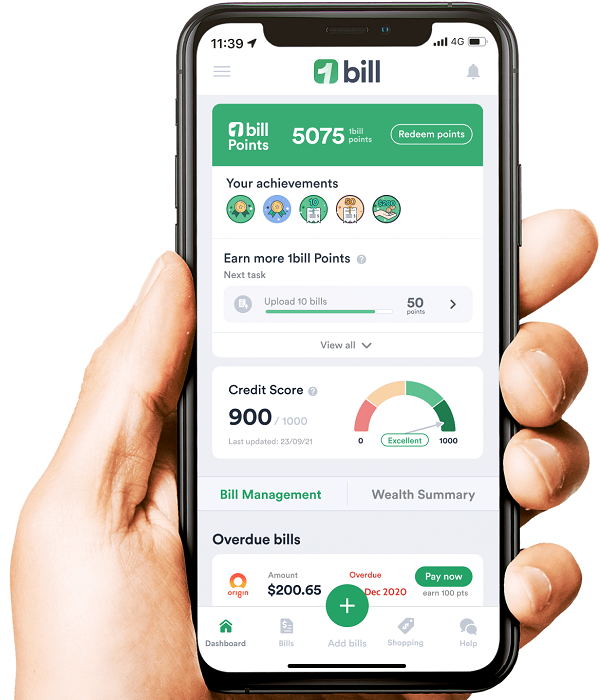

A new app, 1bill, has launched on Android and iPhone that will, for the first time, enable Australians to take control of household bill management and ease bill shock with the ability to consolidate, view and pay bills, switch to better deals, and unlock a ‘Bill Now Pay Later’ function all in one place, while earning rewards.

At a time of national economic unrest coupled with rising household bills, including; broadband, utilities, energy, insurance, Council, Telco and pay TV, 1bill offers the only end-to-end solution to bill management putting everyday Australians back in control of their finances.

As a first mover into the emerging and fragmented household bill management sector, 1bill is the innovation of seasoned business builder, Neil Saligrama and his talented team, who this year celebrate ten years as one of Australia’s largest utility connection and comparison platforms with Compare & Connect. Originally a bootstrapped startup, Compare & Connect is now heading toward a $100 million valuation with a team of 200 talented individuals across Australia.

1bill Founder and CEO, Neil Saligrama, said, “The problem 1bill seeks to solve is very current in the need to provide an end-to-end solution to making bill management and payment easier and more affordable. By offering both management and payment capabilities in one app, the platform is well placed to meet the evolution of the industries in which we operate well into the future, bringing convenience, control, savings and better data and insights for not only consumers but also the retailers and businesses we partner with.”

How 1bill supports Aussie homes to alleviate bill shock

Leveraging the existing Compare & Connect platform as one of the app’s multi-faceted functionalities, 1bill users can view similar offers from a broad range of providers and either automatically or manually switch without ever leaving the 1bill app environment – using its 500,000+ connections and diverse retailer relationships to ensure customers get a better deal.

In addition, 1bill users are able to connect and receive all household bills via the platform, including viewing real-time cost effectiveness to alleviate bill shock at the end of the month. Users can elect to automatically or manually pay bills via the app and 1bill will regularly generate budget and spending analysis. Every action taken within the app enables users to earn 1bill points and badges to unlock and redeem special offers.

Most recently, 1bill has partnered with LatitudePay to provide a unique ‘Bill Now Pay Later’ service, supporting users to avoid financial setbacks when large bills come in by enabling payments to be made over ten weeks, interest free.

Originally conceived of with SMEs in mind, 1bill’s platform technology is available to be white-labelled to companies looking to enhance data capture, consumer experience and the retailer engagement processes.

“Bringing 1bill to life has been the result of years of careful thought, foresight, planning and the incredible talent of our team. We’re thrilled to be ready to launch at a time when we feel our technology can make a meaningful difference for Australians who have needed to become more budget conscious but without the time required to research and analyse the options to do so. 1bill represents an Australian solution to a global problem and we’re excited to grow the business locally with consumers, retailers and partners while getting ready to expand beyond our shores,” Saligrama added.

1bill is a certified Australian Made™ company, proudly designed, owned and operated by local Australian talent. Founder, Neil Saligrama is the primary investor/owner holding the majority of shares, Doma Group-Canberra also hold a significant stake in the venture.

Immediate plans for the startup include launching 1bill into the New Zealand market as a first step in global expansion, as well as launching app functions with targeted support for small businesses, plus Bundle & Split payment capabilities.