Fintech approves home loan on the spot

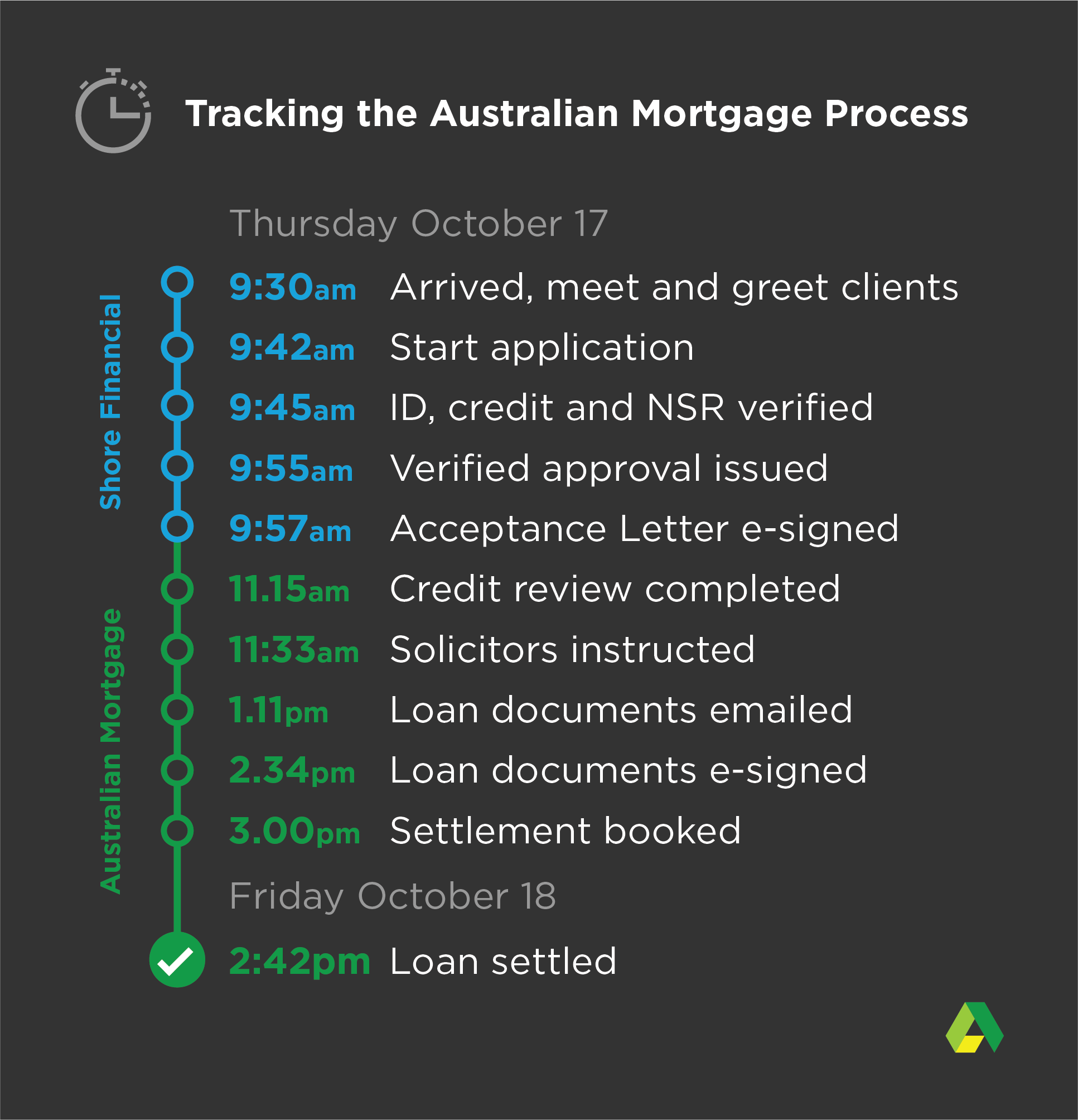

Australian Mortgage announced that they have today settled their first mortgage application in partnership with Shore Financial, and as promised, it was all over in less than 15 minutes.

Using Intelligent Credit™, Shore Financials’ Dana Fraser was able to approve the Parkers’ home loan on-the-spot to give them the certainty they need while avoiding the lengthy delays and red tape typical of traditional bank processes.

Intelligent Credit turns the antiquated mortgage application process upside down by issuing a verified approval up-front, in less than 15 minutes, so that our Broker distribution partners are able to provide their clients with the certainty to act with confidence.

For many, the mortgage journey begins with a conditional pre-approval from a bank. Because in many cases this pre-approval isn’t backed up by verified applicant information, it’s really just an estimate of what they might be able to afford and still requires a full a credit assessment that takes 16 days on average. This is illustrated by the fact that 9 in 10 pre-approved loan amounts are varied on formal approval.

The Intelligent Credit difference is that we verify an applicant’s information with our trusted digital partners, and process that information using our proprietary credit decision algorithms to provide a verified approval. Applicants are issued with an acceptance letter detailing their verified loan scenario that is simply digitally signed to proceed. Customers receive their loan documents via email and are able to execute the loan documents digitally resulting in a significantly faster home loan process.

An Intelligent Credit verified approval empowers home buyers to make confident bids or offers on a home or investment property. For those refinancing, an Intelligent Credit verified approval means skipping past traditional pre-approval conditions, manual credit assessment and information pain points.

The loan settled the very next day. This means the Parkers get the benefits of their lower cost loan faster. That’s Australian Mortgage’s point of difference and its tipped to disrupt the home loan market.

Australian Mortgage is a white label digital home-loan lender seeking to provide an alternative to the big banks and disrupt the home-loan market. The company has launched its pilot program with their first distributor Shore Financial.

“We have received our first loan application and have settled our first mortgage. Funding the first mortgage on our own developed platform is a monumental achievement for the Australian Mortgage team. It’s not just about funding a mortgage, it’s about proving that our best of class system is ready,” said Kym Dalton, Managing Director.

The company’s innovative approach to home loan lending is generating significant attention in the third-party distribution channel. Australian Mortgage has already received commitments from brokerages and mortgage managers to distribute over $2.5 Billion per annum in prime mortgages on completion of its pilot program.

Dalton says: “The company is taking a responsible approach to ramping up its volumes- even so, news of the commencement of our lending operations has generated significant interest from Brokers and Mortgage Managers.”