Effi expands Product Search API to assist more FinTechs in the complex world of open banking

Mortgage broking platform Effi’s product search API, which is already being used by several FinTechs to strengthen their offering in open banking, has expanded with LIXI Codes for lenders and the ability to identify lenders funding the fossil fuel industry which has become an important topic for borrowers.

FinTechs including Sherlok, Australia’s first and only automated repricing and refinancing platform for mortgage brokers, use the API to drive growth for their business and reduce their development overhead when it comes to accessing home loan product information.

Adam Grocke, Founder and CEO of Sherlok, said the chance to work with another FinTech, Effi, in providing a more efficient offering for brokers and consumers is an exciting prospect.

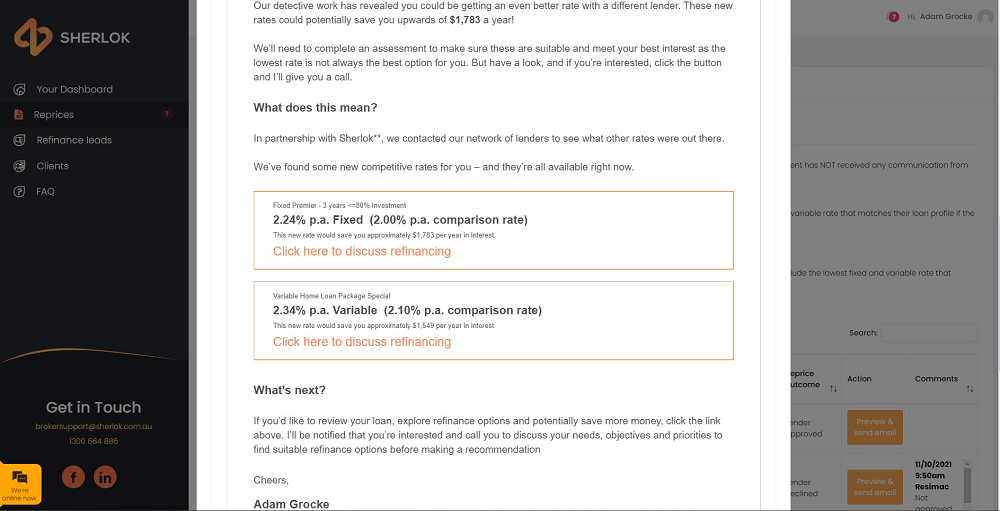

The Sherlok portal powered by Effi API

“Effi’s product search API has allowed our instant refinance comparison tool to match the lowest fixed and variable rate for each individual customer’s loan profile. This means brokers can run a refinance comparison instantly with just a single click. Having that accurate data mapping for loan products is critical to the Sherlok experience,” said Grocke.

“Being able to outsource the management and maintenance of the loan products and mapping has allowed us to focus on Sherlok’s core mission and value – helping brokers keep clients for longer using repricing and refinancing to build retention.”

Open banking has provided the industry with a massive amount of potential, says Grocke, but there’s still a lot of work to be done. The ability to leverage consumer data and lender information to provide deeper insights is powerful, he says, but without tech like Effi’s API FinTech’s need to be able to spare significant additional resources to unlock the value.

Sherlok’s mission is to help brokers keep clients forever through AI-powered retention predictions, automatic rate repricing and single click refinancing. The platform has saved over $2m in home loan interest for customers through identifying high interest rates and repricing them at a lower rate. This helps brokers generate consistent refinance leads after just weeks using the platform.

Using the API, companies like Sherlok are able to help borrowers make informed decisions in the home loan space. The tech can be used to create unique experiences ranging from comparison websites to a detailed repayment calculator in a matter of hours. Effi CEO Mandeep Sodhi believes the possibilities for the API are endless given the size and complexity of the market. We are seeing fascinating case studies where one FinTech is building an internal Slackbot for their team to query the latest interest rate while on a call with the customer.

“Over the last two months we’ve been working to enrich our Home Loans Product Search API with additional features to help FinTechs provide a robust experience for their customers such as LIXI Lender mapping and choose lenders that are funding fossil fuel industry through data from marketforces.org.au,” said Sodhi.

“We are now working to white label widgets and landing pages that will allow Effi brokers to access the power of the API without having to building on top. We’re very excited to be able to bring this service to our clients, and we’re delighted to be able to work with industry-leading partners like Sherlok to further the efficiency for brokers.”

For further information on Effi’s platform, visit www.effi.com.au.