Cost of living increases clearly on show as Aussie households grocery spend jumps 18%: Frollo

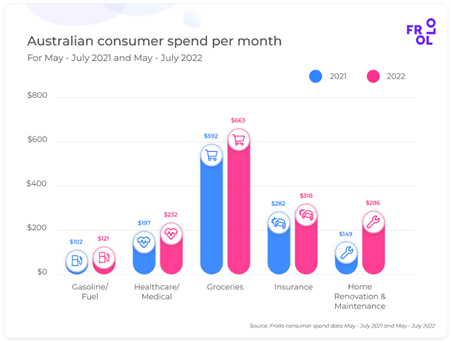

New data from fintech Frollo shows that Australian households are spending significantly more on groceries, as well as petrol and insurance in 2022. A comparison of 35,000 users of the Frollo personal finance app between May – July 2022 and the same period in 2021 shows monthly spending on groceries is up 18%, from $592 to $663.

This news comes as little surprise after inflation reached 6.1% in the June quarter, according to the ABS, the fastest annual pace since 2001. Despite the previous government having cut the fuel excise, average fuel spend in May and June also was still significantly higher than the corresponding period in 2021. The average household fuel spend increased 19% in 2022, from $102 to $121.

Other areas where Aussie households are spending more than last year are healthcare and medical expenses (up 18%, from $197 to $232) and insurance (up 13% from $282 to 318).

Boomers are renovating and eating out in 2022

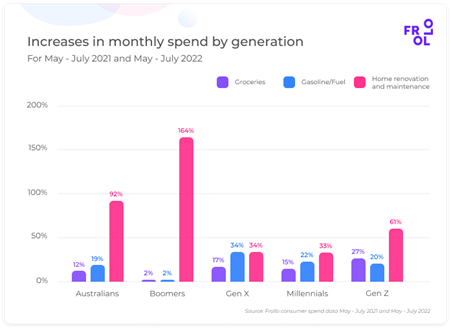

Although each age bracket is spending more in 2022, there are some clear differences between generations when it comes to where the money is going.

Baby boomers are the primary driving force behind the increased ‘home renovation & maintenance’ spend in 2022, more than doubling their monthly spend in this category (+164%, from $244 to $646). Although boomers also saw an increase in groceries (+1.7%) and fuel spending (1.9%), these increases were small compared to those for other generations.

Gen X seems to be most impacted by the fuel price increases, spending 34% more on fuel per month in 2022 than in 2021 (from $115 to $155). With lockdowns in various parts of the country between May and July 2021, Gen X could also be more inclined to take the car to work again in 2022.

Another category the spend data shows a clear difference between 2021 and 2022 is hospitality. Monthly spending on restaurants, pubs, cafes and takeaway is up 22%, from $1,675 to $2,048. Although each generation spends more in 2022, Boomer hospitality spend has increased the most (+35%) and Millennial hospitality spend increased the least (+11%).

The importance of money management

With inflation and interest rates increasing, many Australians are facing mortgage stress or even financial hardship. The average Australian has at least two different banking relationships and five or more different financial products, so it can be hard to stay on top of finances.

Money management apps like Frollo offer users an overview of all their finances in one central place, smart insights to understand their financial situation and the tools to improve their finances.

Banks are starting to catch up. Beyond Bank recently launched a financial wellbeing app that shows customers all of their finances, including accounts with other financial institutions. And CommBank, Bank of Queensland and Virgin Money Australia have started integrating spend graphs, insights and budgeting tools in their banking app to help customers better manage their money.

When money management tools are done right, they can have a profound impact on the lives of Australians. The average Frollo user:

– Reduces their credit card debt by $470 in the first 6 months

– Reduces personal loan debt by $4,200 in the first 6 months

– Increases their savings by $1,200 in the first 3 months