Cost of living crisis laid bare as essentials jump 19% in 12 months

Australians are experiencing a significant increase in the cost of living in Q3 2022 compared to Q3 2021. Using data from its money management app, Australian Open Banking provider Frollo found that Australians’ monthly spending on items classified as ‘essential’, like rent or mortgage, groceries, insurance, fuel and medical, has increased by 19% in the last 12 months.

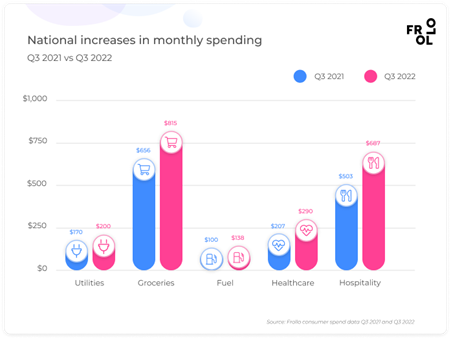

Other key findings included:

- Monthly medical expenditure (not including insurance) has increased the most; a 40% increase from $207 to $290

- Fuel spending has increased by 38%, from $100 to $138 per month

- Grocery spending has gone up 24%, from $656 to $815 per month

- Monthly spending on utilities (water and energy) has increased by 18%, from $170 to $200

Less essential but not less interesting is the increase in hospitality spending. Compared to Q3 2021, Australians spend 37% more on restaurants, cafes, pubs, and takeaway. Monthly expenditure on these categories has increased from $403 to $687. This is not surprising, given that many cities were in lockdown a year ago.

Kris Davant, Head of Product at Frollo said, “The numbers show that many Australians are finding it challenging at the moment. Many of the things they’re spending more on are essentials like groceries, medical bills, and utilities. With the holidays coming up, things will probably not get much easier any time soon.

This is why we’re so passionate about improving Australians’ financial well-being. By making our own financial-wellbeing app available for free and by providing our partners with the tools to help their customers turn around their finances.

Millennials’ medical expenses leap as Boomers battle fuel costs

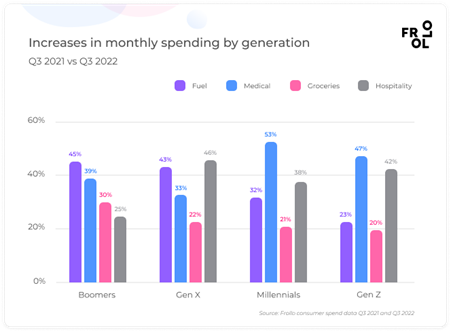

Although the cost of living is increasing for all generations, specific age groups are impacted differently.

- The most significant increases for Boomers are on fuel and medical spending. Fuel spending is up 45%, from $116 to $168 per month and medical spending is up from $298 to $413 per month (+39%)

- Gen X are spending 46% more on hospitality, the biggest increase of all generations. This is up from $558 to $813 per month. Their second biggest spending increase is on fuel, up 43% from $119 to $171 per month

- Millennials’ biggest percentage increase is on medical spending, up by 53%, from $154 to $234. Their second biggest increase is on hospitality spending, up by 38%, from $504 to $693 per month

- Gen Z’s medical spending has also jumped significantly, albeit from a much lower base. Their medical spending increased by 47%, from $67 to $99 per month

Each generation spent between 20% and 30% more on their monthly groceries in Q3 2022 compared to Q3 2021.

State vs State: South Australians’ utilities bills have doubled

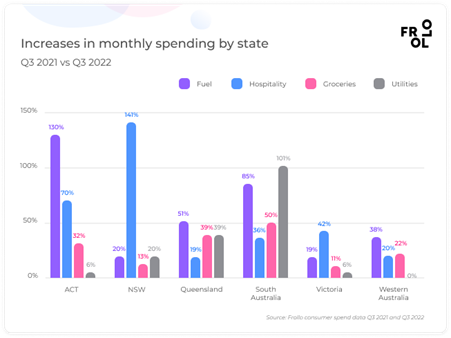

Not only are there differences between generations, but these differences also emerge when we compare states.

- In the ACT, fuel spending has more than doubled (+130%) compared to 2021, from $70 to $162 per month. Hospitality spending is up by 70%, from $408 to $694

- The most significant spending increase in NSW was on hospitality (+141%), from $506 to $1,221 per month

- In Queensland, the largest expenditure increase was on fuel, 51% up from $101 to $154 per month

- South Australians spent 101% more on utilities in Q3 2022 than in Q3 2021. Their monthly utilities spending was up from $117 to $250. SA residents also spent significantly more on fuel (+85%), up from $80 to $148 per month

- Most spending categories increased by less than 20% in Victoria, except for hospitality. Spending in this category was up by 42%, from $511 to $728 per month

- In Western Australia, the biggest spending increase was on fuel, up 38% from $115 to $158 per month. Interestingly, spending on utilities was flat year on year

Budgeting now more important than ever

Kris Davant said, “Staying on top of your finances can be challenging, especially when you have more than one bank account or a credit card with a different financial institution. With the cost of living increasing, it’s more important than ever to get a grip on your finances.

And banks can play an essential role in helping their customers turn their finances around. For example, some customer-owned banks like Beyond Bank and P&N Bank have recently launched financial well-being apps for their customers, focused on helping them get a full view of their finances – including accounts with other banks – and providing them with insights and budgeting tools.

It’s a good start; many Australians can use all the help they can get right now.”