CommBank launches buy now pay later disruptor StepPay

CommBank has launched StepPay, its new buy now pay later offering, which is available to up to 4 million CBA customers.

CBA’s Executive General Manager, Marcos Meneguzzi said, “We’re excited to create the first BNPL from a major bank which can be used anywhere our cards are accepted. We know BNPL is a popular choice among customers, but is hampered by its limited use and availability in only selected retailers and businesses. With StepPay, customers have freedom around where they’d like to shop, offering the same accessibility as our other CBA cards.”

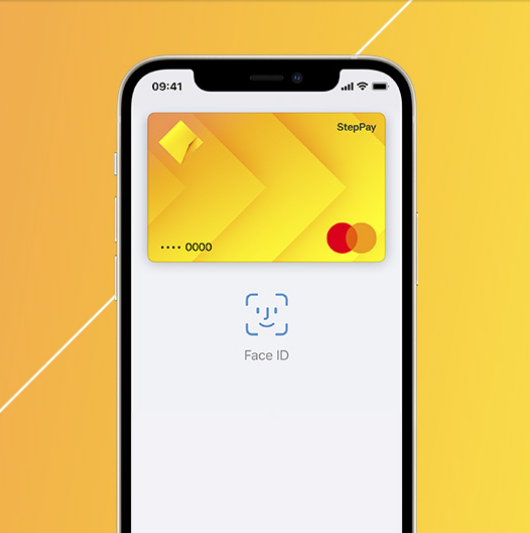

CommBank customers are able to download and start using StepPay from today – which should take most customers less than five minutes to do. As CommBank’s first cardless payments offering, eligible customers can start using it as soon as they have activated it online.

Over 86,000 customers have already pre-registered for StepPay showing the appeal of a bank offered BNPL.

“StepPay is a win particularly for smaller businesses who may be charged a high fee in order to offer BNPL to customers. With no additional merchant costs or integration costs, StepPay levels the playing field and allows businesses to better compete,” said Meneguzzi.

StepPay applies robust criteria to approve customers based on specific eligibility and credit assessments.

“Creating a responsible BNPL is at the forefront of StepPay’s design. And while we expect it will have great appeal among customers, it will only be available to eligible customers so we can offer the most responsible option we can,” Meneguzzi said.

Available to eligible CBA customers, StepPay links to an eligible CBA bank account.

Eligible customers must show evidence of regular income or deposits into a CBA transaction account to cover repayment instalments and is subject to internal and external credit assessments.