Class launches Class Trust to support accountants with recent ATO Trust Income Schedule requirements

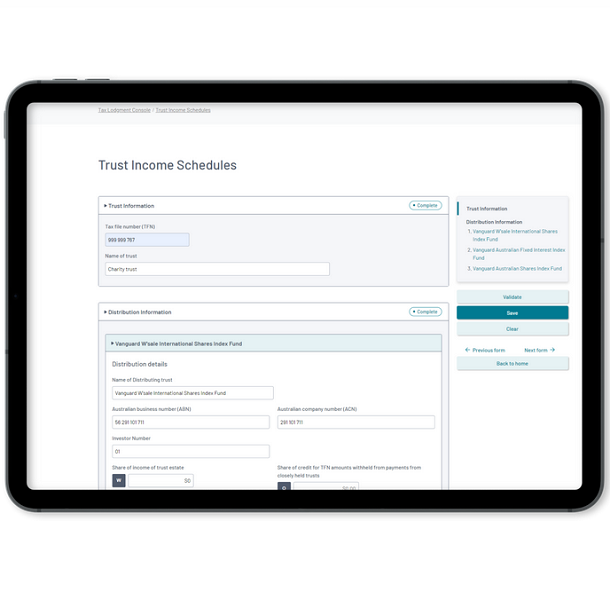

Class has launched an enhancement to its trust accounting and administration software cloud solution, Class Trust, which automatically generates the new Australian Taxation Office (ATO) Trust Income Schedule (TIS), eliminating the need for manual entry and ensuring compliance with the latest trust reporting requirements.

As part of the ATO’s Modernisation of Trust Administration Systems project, new tax return changes effective from the 2023-24 income year require all beneficiaries who receive trust income from 1 July 2023 to lodge the new TIS with their tax return. The latest ATO figures show there are 947,264 trusts with assets of $2.3 trillion.1

Class Trust enables accountants to auto complete and reconcile income distributed from trusts including unlisted trusts, listed securities, managed funds and stapled securities into the TIS, eliminating the need for manual entry.

According to Class CEO Tim Steele, this latest enhancement highlights the ability of Class Trust to support accountants to adapt to regulatory changes and efficiently manage the complexity of administering trusts.

“Class Trust is designed to provide accountants with an automated, streamlined and compliant TIS which simplifies the administration of trust entities at tax time while also reducing the complexities of reporting and lodgment requirements. Trusts are often in the spotlight and its critical accountants efficiently adapt to new regulations so they can continue to cost effectively deliver great client outcomes.”

Other features of Class Trust include:

- Automated Investment Tracking and Reconciliation: Save hours of manual entry with automated investment tracking and reconciliation, generating financial statements and tax reports on demand, customised to your firm’s needs.

- Standardised Administration Processes: Simplify trust administration through a standardised approach, regardless of which team member is preparing the accounts.

- Real-Time Distribution Decisions: Make distribution decisions before 30 June based on up-to-date information, accessing financial year-to-date income, franking credits, and capital gains at any time.

- Automated Tax Statements: Streamlined application of tax statement components to distribution income, dramatically reducing manual data entry and tax reconciliations preparation for lodgment and the ATO’s new Trust Income Schedule.

- Efficient Trust Distributions: Save time with automatic calculation of income components available for each beneficiary, including our powerful income streaming feature.

- Electronic Lodgment: Lodge tax returns electronically with the ATO, saving hours of manual data entry.

To find out more information on the enhancement, visit Class Trust Income Schedule.